The younger you start, the more wealth you’ll grow. You need to set goals, develop a strategy to reach them, stay the path, review and step it up again.

Like health and fitness strategies, anyone can achieve success if they are committed to achieving the outcomes they’re striving towards.

Expert help, encouragement and guidance along the way, will keep your wealth growing.

On the go? Here’s 30 seconds of key take outs:

- The younger you start investing, the deeper you’ll grow your knowledge and your income producing assets – your wealth.

- Clearly defined goals are the foundation for growing wealth.

- Focus on a growth strategy while you’re young. Income producing assets will set you up for an enjoyable and early retirement lifestyle, if you want it.

Keep reading >>

Make property investment your trade

Many first time investors come to us baffled by the conflicting advice they’ve been given from friends, families and peers.

The most effective wealth growing strategy is one that is personalised to your individual goals, lifestyle and financial situation. Investment strategies are never a one size fits all solution.

An old mentor once told me that the way to successful property investment was to make it your trade.

What he meant by that was to explore beneath the surface (I was a Bubble Head in the Navy at the time, so it was a good analogy!), and gain deep knowledge of my new trade.

His advice has paid off, and now I’m determined to pass on my knowledge and experience on to others.

Goals: the linchpin that keeps your strategy mobile

Goal setting puts you on the 110 km per hour freeway versus the 80 km per hour main road. The freeway will see you reach your destination faster, with fewer disruptions and less wear and tear!

If you haven’t set goals yet, read our blog article ‘Property investors squash distractions by setting goals’, before you read any further.

How do you start building wealth?

I started building my property investment portfolio while I was in the Navy. From my experience there are three steps to building wealth once you’ve defined your goals:

Wealth building step #1: Get a steady, secure income

No. You can’t skip this step. The discipline that comes from earning a steady, secure income is the discipline you’ll need to apply to committing to achieving your investment goals.

If you’re in the Defence Force, this is awesome because the ADF offers a progressive pay scale. Stick with it for a while, progress up the ranks, and your pay goes up.

Wealth building step #2: Save a portion of that steady, secure income

No. You can’t skip this step either. You need to master your savings, and experience the power that putting aside money regularly can give you. You will need a deposit and a history of savings before banks will consider giving you a mortgage. For your deposit, you’ll need between five to 20 per cent of the purchase price of the property. You’ll also need to show at least three to six months of a history of regular savings. It’s that discipline again!

$45,000 will generally give you the deposit you need to start growing your wealth with what we call a good buffer.

Wealth building step #3: Repeat steps 1 and 2 and do it again, and again

One investment property is not going to give you the level of income producing assets you need to be financially independent in your retirement years, particularly if one of your goals is to retire from the workforce early.

Early on in your property investment building strategy, you need to accumulate as many assets as you possibly can within your capacity. By keeping it simple at this stage, you’ll learn what you’re doing, and why it’s working for you. We call this the asset accumulation stage – more about that later.

With a good strategy at play, and multiple investment property purchases over time you will reach, and in many cases, exceed your goals.

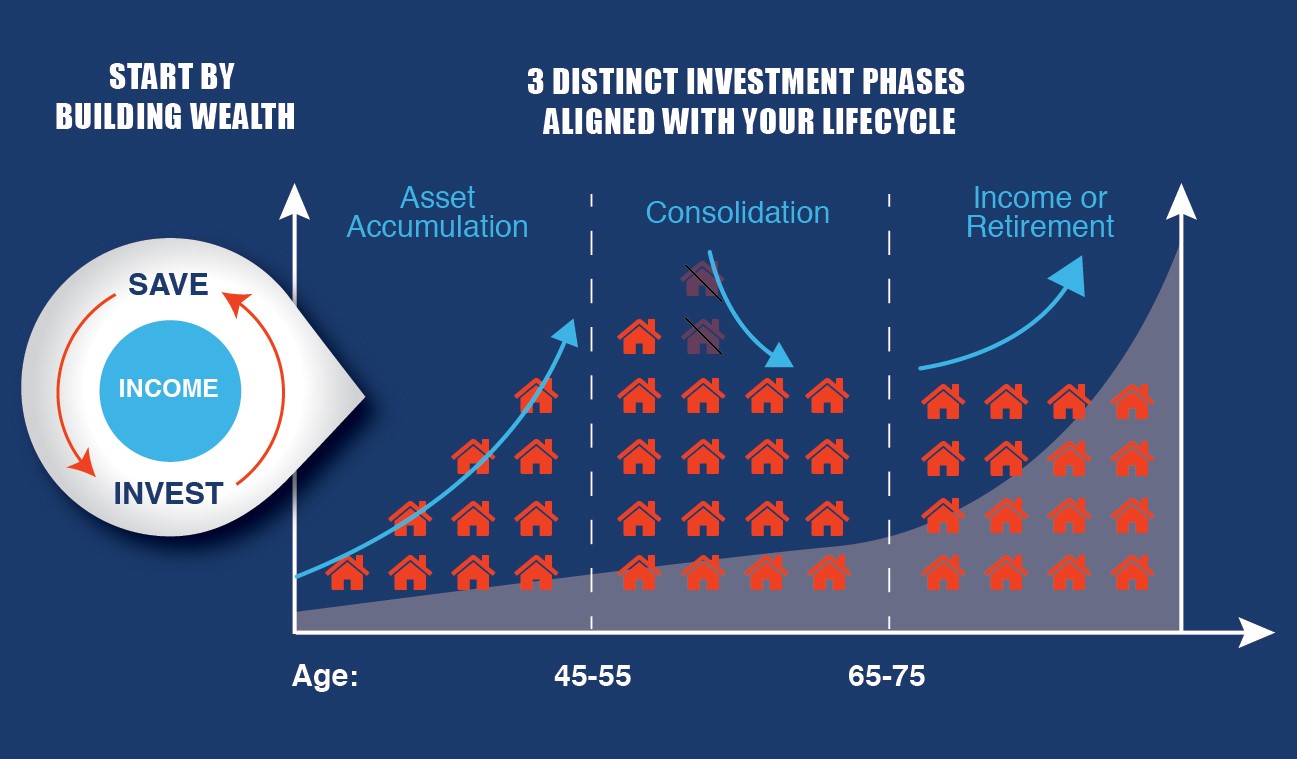

3 distinct investment phases aligned with your lifecycle*

Depending on where you are in your wealth building strategy, it is worthwhile explaining the three investment phases common to successful property investors:

#1 investment phase: the Asset Accumulation Phase

Ideal for young investors in their early to late 20s and through to early 30s, this is the phase where you invest for growth – that is plan multiple property investment purchases over a longer period of time.

If you’re earning a steady, secure income from employment, research into your investment strategy should be from a long term perspective. While you don’t need the additional income right now you will benefit from the tax breaks available – for example, through gearing your investments.

Proven data shows that long term investment in property yields the best returns. Properties near major capital cities are a great source of longer term capital growth because of sustained population growth over decades.

The longer you hold on to a property asset, the better off you’ll be in terms of growing wealth. If you’re starting your property investment strategy in your 20s you’ll see several property cycles through while you buy and hold properties.

#2 investment phase: the Consolidation Phase

Your early to mid-fifties is ideally where you are best placed for the consolidation phase. This is the phase where you may be looking for some flexibility in your working hours.

You could choose to sell some of your accumulated property assets to reduce debt, and conversely, increase your cash flow. This is an example of how you can personalise the opportunities offered by your wealth assets, depending on your lifestyle priorities.

#3 investment phase: the Income or Retirement Phase

If you’ve started investing in your 20s, this phase could come well before your mid-60s. This is where you decide you want to transition from, or exit, the workforce and need income to support your lifestyle through the rest of your retirement years.

This income may be supplemented by some superannuation. It is unlikely that the option of also supplementing with a government pension will continue to be an option for much longer. It is a limiting financial option anyway. This is why a healthy wealth growing strategy today is focused on income producing assets.

Did we mention the earlier you start building wealth the better the outcome?

While it is never too late to start investing, the earlier you can tap into a good disposable income, the better the future will be.

If starting a family is one of your life’s hopes, a home mortgage and funds to raise children will channel most of your disposable income, making it harder to find spare funds to invest.

So, our advice is to start as early as your imagination will allow you to. If it is your imagination, or thinking, that is the only thing stopping you – it is time to set some goals, and plan a strategy. We can help.

To recap on this and previous blog articles:

- Explore and set some solid lifestyle goals for the short and long term

- Work out how many income producing assets (properties with good capital growth potential) you’ll need to achieve these goals.

- If you’re young, focus your strategy on growth for income producing assets to fund a great retirement lifestyle.

Start investing now. Don’t be left wishing that you’d started earlier.

Get some experts around you to help you on your way.

Free investor tools: 30 page Quick Start guide | More Switched-on Strategy Series