Pre-Order Property Investment SOP here.

Like any trade qualification, there is knowledge to acquire, and skills to master, and it takes commitment and focus to move beyond an apprenticeship and into earning an income that can support your goals.

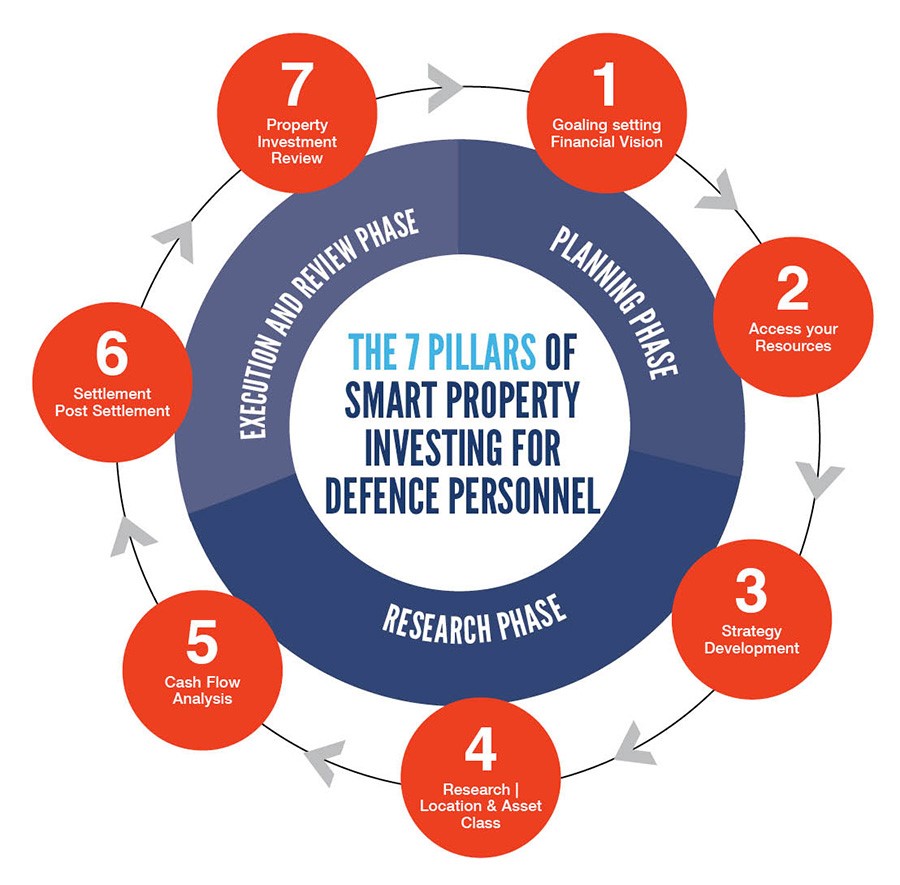

From years of personal experience, along with helping others achieve their property investment goals, I’m handing to you what I know to be the seven key pillars that support wise property investing time and time again.

On the go? Here’s 30 seconds of key take outs:

- To turn property investment into a trade that will fund your lifestyle goals, you need to be well informed first, and then plan an approach that has been tried and tested.

- The most efficient way to gain knowledge in this trade is to build a team of property investment experts around you. This is one of the key pillars of successful investing.

- You’ll revisit these seven pillars of property investment again and again, as these supporting pillars never change. If you ever find yourself wavering on your investment journey, it’s time to work back through these and reset your plan.

Keep going >>

Here are the seven pillars of successful property investment. Keep them handy:

1. Set financial goals to support your lifestyle goals

If you use GPS to set your destination to get there by the most efficient route, why wouldn’t you apply the same principle to life? Simply by defining your goals and writing or typing them down, you’ll position yourself to earn 9 times more in your lifetime than your mate that has no idea of their destination.

2. Understand your financial position to access sources to invest

Once you know where you’re going, you need to understand your financial position today so you can work out what financial resources you can access to achieve your goals. To borrow for an investment property, your financial records will need to be ship shape. Then it’s off to a finance broker to find out what your borrowing power is.

3. Build your strategy by putting a team of experts around you

Your financial goals won’t be the same as your mate’s. This is why a one size fits all strategy is a myth. Once you’ve got your goals and where you are now down, it’s time to get a team around you that can offer expert guidance on how to bridge the gap to achieve success.

4. Make strategy driven decisions backed by proven research criteria

Proven property investment research criteria will help you choose the right property. Start with a nationwide, capital city view of the Australian property markets, then narrow it down based on detailed location criteria. It’s a zoom out, zoom in approach. Once you’ve targeted a local area, you need to research what type of asset best fits your strategy. When you’re young, your focus is towards growth.

5. Understand cash flow analysis to succeed in property investment

The zoom out, zoom in location criteria for choosing property are two of three key investment principles.

The third is cash flow analysis – a great skill to tuck under your Defence cap. Practiced enough, you’ll know exactly where you’re sitting in terms of your cash flow, and how an addition to your portfolio might take you toward your goals.

6. Get educated on pre-settlement and post-settlement milestones

In the process of buying investment property, you need to achieve some key milestones before and after the settlement takes place. By educating yourself before you buy your investment property you’ll avoid costly risks like attracting penalty interest and facing longer construction times. You want to reduce your exposure to risk – always – by shortening the time frame from handover to tenancy.

7. Review your property investment

With good planning based on expert advice, property investing is a set-and-forget strategy – but that doesn’t mean you forget about it completely! Property markets shift. Economic conditions shift. You need to be ready to shift too. Regular review of your cash flow position, the property market, the rental market and taxation changes are essential to maximise the return on your switched-on investment strategy.

Having an expert team of property professionals around you will streamline your approach. For example, keeping a simple but detailed property investment spreadsheet at the ready for your accountant will give you a clear sense of where you’re at on your road trip toward your destination.

Your next step starts today

Set aside a good, focused block of time to indulge in building a plan for your future.

Grab a pen and a piece of paper – or if you’re an app fanatic, open your favourite note organisation app – and get ready to make loads of notes. Use the information, tools and resources available to you on Capital Properties website to propel yourself into action!

Get some experts around you to help you on your way.

Free investor tools: 7 step process to successful investment in property PDF | Our Switched-on Property Investors Program | Discovery Session | The Capital Properties Investor Quiz | Pre-Order Property Investment SOP here.