Take advantage of the Capital Properties Pinnacle Support Program

Are you On Track or off track to meet your goals?

So much has changed in the world of finance and property investment in the last couple of years. If you haven’t been keeping up with these changes, you might be missing out on some serious opportunities. Even if you’ve been staying up to date with our Capital Properties news posts, it’s important to make sure you’re still on track to meet YOUR goals.

The experts at Capital Properties recommend taking time at least once a year to meet and re-evaluate your property investment and long term financial and lifestyle goals. During this catch up we can make sure you’re on track to achieve your goals and are actively taking the next best steps to get you there. So, if you’re due for a review, don’t put it off a second longer. Book in here.

The Capital Properties Property Investment Tools & Apps and essential resources from our Capital Properties Pinnacle Support Program will help you take stock and make smart decisions for now and the long-term.

On the go? Here’s 30 seconds of take outs:

- It’s vital to regularly review your progress against your goals. Make sure you’re on track and know the next steps to take to achieve your long-term vision.

- Working on your financial, lifestyle and property goals can feel overwhelming. We’re here to help with a range of free tools and our Pinnacle Support Program review.

- Our Pinnacle Support Program Review supports you to achieve what’s important to you – and it can all be done over the phone to fit in with your schedule.

Keep reading >>

Still set to achieve your goals?

Due for a review? We know that life gets busy, and the weeks turn into months so quickly, before you know it years can have flown by. It’s easy to feel overwhelmed with so much to keep on top of. Can you be sure that you’re consistently doing everything you need to maximise your potential and achieve your goals?

That’s where we can help. We developed the Capital Properties Pinnacle Support Program to make sure you stay on top of your game with as little effort as possible. If you’re not confidently answering these questions below, then get in touch for a review so we can make sure you’re still on track.

Ask yourself truthfully:

- Am I clear on what my end goals look like?

- Am I on track to achieve those goals?

- When was the last time I updated my Asset and Liabilities spreadsheet?

- Are my weekly, monthly, yearly tasks all set to achieve my goals?

- When was the last time I did a desktop valuation / full valuation of my investment property?

- Are my tax returns up to date?

- Am I up to date with the latest statistics for my property’s suburb?

- When was the last time I viewed a suburb profile for my property’s area?

Do I know what I need to do next to progress my goals?

Lifestyle goals changed?

Property investing is a journey not a destination. Some of your goals can take 10 to 20 years and it’s normal to feel some resistance along the way – that’s just life!

In the last few years, I’ve taken stock of my total property deals since I first began investing in 1998. From starting as an absolute novice to completing over $6million in property transactions, grossing over $2million. In my early days in the Navy, I couldn’t have dreamed of this kind of financial security. But I applied the Capital Properties Property Investment strategies and stuck to my goals, even when it wasn’t easy. In fact, it’s during the tough times that these strategies and our expertise can really make the difference.

“When everything seems to be going against you remember that the airplane takes off against the wind, not with it.” Henry Ford

Setting goals and achieving them means more than making money. It’s helped me realise the lifelong dream I had to build my dream home. I’ve created generational wealth to make sure my family is looked after. And I’ve developed relationships with professionals that means Capital Properties continues to grow and thrive so we can share our success with you.

Let’s take stock

Even if you feel like you’re in a great place right now and your investment(s) is working hard for you, it’s worthwhile taking a moment to re-evaluate. Like the property investors hymn says “One property is good. Two is better. Three offers more opportunities. Four or more becomes a challenge to manage but really opens up your options and the ability to get set up.”

Review financial & lifestyle objectives

Simple and yet profound! Get started by taking our Investor self-evaluation test with our free Capital Properties Goal Setting Toolkit

- Mind map your goals

- Write a plan outlining how to achieve your goals

Create an action list

Complete an Assets and Liabilities Worksheet

This is the easiest way to get a visual on your inflows and outgoings. Your financial situation will become clear and you’ll be able to see where you need to make changes. Also, where you can make the most of opportunities. You’ll find the Capital Properties Net Asset Position Calculator and Assets & Liability Calculator here.

Take it further with the Pinnacle Support Program

Book in for your Pinnacle Support Program Client Review here. Here’s a taste of what you can expect:

– Latest property data and research

To help you evaluate your investment property(s) cash flow position and comparative market analysis, we’ll review the latest data including:

- RPdata suburb and statistics reports for each property

- Residex suburb reports

- The latest Forecast ID demographic reports

- Desktop and full valuations

- Rental manager feedback and reviews

The latest vacancy rates data

– Strategy development

Once you know how your investment(s) has performed we’ll work out an individualised strategy to continue building your wealth. Our finance team will confirm your new borrowing capacity. From there we can discern the next best steps forward. That might look like one of the three options below.

- Option A. Capacity for a new purchase

If you have capacity, we can start to explore property investment opportunities in line with your budget and goals. We know you’re busy, so much of the process can be executed over the phone to work within your Defence Force schedule.

- Option B. Increasing capacity

If your current situation doesn’t allow you to make your next investment just yet we’ll give you some steps to implement, such as tenancy and maintenance tips that will increase your capacity and help you get closer to what’s important to you.

- Option C. Consolidation

You might want to consolidate your finance, find better than your current interest rates and reduce your investment/personal debt. Our finance team can assist you with negotiating interest rates directly with the bank and/or refinancing your current loans.

Again, if it suits you better and to save your valuable time, we can do all, or most of this over the phone.

The next best step?

We want you to realise your financial and lifestyle goals using our tried and tested property investment strategies. And we know that the unique demands of Defence life mean you don’t always have time to stay updated and make sure your investment(s) is working the hardest for you.

Our Pinnacle Support Program is designed to make this process as easy and efficient as possible. After completing the Pinnacle Support Program Client Review you’ll have a clearer vision of your current situation and what’s important for you do on a day to day basis to achieve your goals. As the proverb says: ‘Iron sharpens iron, so one person sharpens another’. So, if you’re due for a review, the sooner we get to it the better.

We designed our Capital Properties Switched-On Strategy Series and Capital Properties Pinnacle Support Program for you. Along with free investor tools like our Property Investor – Self Evaluation Tool, we’ll make sure you reach your goals.

Call us on 1300 653 352 to get the ball rolling.

What is gearing?

In property investment, the term ‘gearing’ describes borrowing money to buy a property. In other words, if you take out a loan to buy a rental property, your investment is geared. Most investors use some gearing – aka, a loan or mortgage, to fund their rental property.

Gearing also determines the cashflow of your investment. Cashflow is the amount of money you have when you’ve received rent from your tenant minus the expenses associated with the property. In summary: cashflow = total rental income – total rental property expenses. In this blog post, we’ll explore the concepts of negative, neutral, or positive gearing and cashflow and explain what it means for property investment.

Positive, neutral and negative gearing strategies have different benefits and risks. So, making the decision about how to gear your property should be made according to your personal circumstances, risk tolerances, current income and property investment goals. We can help you decide what which option is best for you at our free Capital Properties Discovery Session.

On the go? Here’s 30 seconds of take outs:

- Gearing describesborrowing money to buy an asset.

- Cashflow = total rental income – total rental property expenses.

- There are 3 types of gearing: positive, neutral and negative.

- Positively geared = the rental return is more than your expenses.

- Pros = Positive cash flow, great for investors, passive income.

- Cons = Taxed, less positively geared properties, less capital growth.

- Negatively geared = rental return is less than expenses.

- Pros = Long-term capital growth, tax deduction & high rental demand

- Cons = Capital loss, limited cashflow & potentially more volatile.

- Neutrally geared= the income and expenses are equal.

- Pros = Tax neutral, less risk, great for investing with super.

- Cons = Hard to maintain, neutral cashflow, unpredictable.

- When you sell the property for profit you’ll have to pay capital gains tax.

Keep reading >>

Why is ‘gearing’ important?

When you borrow funds to invest in an investment property, the aim is to generate an income from the asset. This income might come from the rent, or capital gains, or a combination of both.

The income earned will either positively, negatively or neutrally geared, depending on the amount you are paying back to your lender and other expenses.

A positively geared property means that your rental return (i.e. the rental income you receive from your tenants) is higher than your interest repayments and other property-related expenses.

A negatively geared property means your rental return is less than the amount you must pay on interest repayments and property-related expenses.

A property is neutrally geared if the income and expenses are equal and balance each other out.

Pros & cons of NEGATIVE gearing

Negative gearing happens when the rental income generated by an investment property is less than the expenses for owning and maintaining the property. Although this might seem like a loss when you have to pay money out of your own pocket, there are some immediate and long-term benefits to negative gearing, as long as you can confidently cover the costs through other investments or your Defence Force income.

Pros of negative gearing

Long-term capital growth

Many investors will purchase a property in a location with strong predicted future growth (usually between 7 to 10 years) so when it grows in value, they can sell it for a profit. With the right property, the gains from capital appreciation will outweigh the losses over the previous years.

Tax deduction

One of the main advantages of negatively gearing an investment property is the ability to offset any loss incurred during that financial year against your salary and any other income you earn. This reduces your overall taxable income and how much tax you have to pay.

You can claim tax deductions on depreciation on the actual property, building works and maintenance, capital goods e.g. dishwasher or washing machine, property management fees, body corporate fees, insurances, land tax, stamp duty, mortgage fees, council and water rates etc. In many cases, the tax savings can be greater than the total net loss of the negatively geared property.

Low rents = high demand

Maintaining lower rents helps to create great long-term relationships between tenants and landlords, resulting in less agency fees and costs to advertise for new tenants. It usually means that the property is less likely to be vacant for long periods of time.

Note, in Australia, there have been calls (in particular by the Greens party) to phase out negative gearing in order to address the housing crisis. But the Albanese government is clear that the policy is not up for review, saying in a memo “We have no plans to change negative gearing rules, and don’t intend to reheat policies from the 2019 election”.

Cons of negative gearing

Capital loss

Although properties will usually experience capital growth, it’s possible that the property market could fall in the area you invest in. That’s why it’s key to do your research before you invest. Our experts write blog posts like “How to buy well” to help you with this, though a one on one chat with our Buyer’s Agent will be even better.

Limited cash flow

If you’re highly geared, you’re more vulnerable to rate rises, which can tighten your cash flow. Less cash flow also means a reduction in your borrowing capacity, making it harder to grow your portfolio.

Potentially more volatile

If you lose your main source of income or can’t find tenants for an extended period of time – you may not be able to cover your loan and interest repayments. Defaulting on payments means increased fees and could even result in having your property repossessed.

Pros & cons of NEUTRAL gearing

Neutral gearing is also known as break-even gearing or cashflow-neutral. This happens when the rental income just covers the expenses associated with the investment property. There may be a small loss or profit, but it’s insignificant enough to make any changes to your tax status. In reality though, neural gearing is a strategy that’s difficult to maintain due to fluctuations in income and expenses.

Pros of neutral gearing

Tax neutral

Neutral gearing doesn’t provide immediate tax benefits in the same way as negative gearing, however the interest and other charges involved with borrowing money can be deducted from your overall taxable income. If your income and spending remains the same, there will be no change to your tax status.

Less risk

In a neutrally geared property, there are little to no costs related to its upkeep. This reduces the immediate financial burden, allows a more predictable cashflow and is an attractive option for risk-averse multi-property investors who stand to benefit from capital gains.

Great use of super

Neutral gearing works well when you’re investing through a self-managed super fund (SMSF), as it doesn’t reduce the fund’s wealth.

Cons of neutral gearing

Hard to maintain

Neutral gearing doesn’t usually happen naturally as there are always going to be fluctuations in rates, expenses, tenancies etc. Unless you’re a seasoned property investor with a significant property investment portfolio and a flexible accountant, it’s unlikely you’ll be able to maintain neutral gearing consistently.

Neutral gearing – neutral cashflow

If you’re not prepared for changes, e.g. increasing rates if your loan’s coming off a fixed rate, managing cashflow in a neutrally geared property can be challenging. You could inadvertently end up in a negatively geared situation and struggle to meet the demand of the increased expenses.

Unpredictable

No matter how stable your current income and circumstances, there’s always a possibility that something might change and create a very different financial situation. Think illness, divorce etc. Inadvertently falling below the minimum threshold and/or having to default on your loan might mean that you’ll have to make an immediate additional cash deposit or sell other investments to cover penalties. Your lender could also ask for the loan to be repaid in full immediately.

Pros & cons of POSITIVE gearing

When the rental income from an investment property exceeds the expenses, this is called positive gearing. That means the rental payments from your tenants will cover all maintenance costs, mortgage fees, interest payments etc, as well as an amount of superfluous cash!

Pros of positive gearing

Positive gearing = more cash flow

Positive gearing leads to positive cash flow and ongoing profits which can be a useful income stream for investors. That immediate income can be used to top up daily expenses, pay down the mortgage, put into savings, or re-invested. A positive cash flow also means less pressure if your financial circumstances change.

Great for investors

Positively geared properties are considered less risky than negatively geared properties and that makes them highly attractive investments. Investors with positively geared properties will usually find it easier to secure another home loan, which will help to expand their property investment portfolios.

Passive income

Buying a positively geared investment property means that you’re able to generate a steady income stream while still being able to benefit from the property’s long-term capital growth.

Taxable rental income

When your property is positively geared, the net rental income is subject to income tax, along with your other sources of income, so you can expect a hit at the end of the year. However, you can claim on depreciation, mortgage interest and any rental expenses to maximise your returns.

Finding positively geared properties

In Australia, 60% of investment properties are negatively geared. So positively geared properties are in high demand. And of course, high demand = higher prices and that often means lower rental yields. Therefore, it’s vital to consider if the cash flow covers interest rate fluctuations, vacancy periods, maintenance costs etc.

Less capital growth

Positively geared properties often tend to be in rural or regional areas, which may not deliver the same capital growth.

Consider capital gains tax (CGT)

We can’t discuss gearing without quickly referring to capital gains tax. Just as we pay tax on any income, we must also pay tax on any net profit we make when we sell a property. As the profit is generally a capital gain, the tax on this profit is called the capital gains tax (CGT).

The amount of CGT we pay depends on multiple factors. For example:

- The property purchase price.

- Time of ownership– You may be eligible for a discount on your CGT if you sell for a profit after more than a year of ownership. Note, CGT does not apply to your primary residence if it hasn’t generated an income.

- Property sale price.

- Your current taxable income. Capital gains are taxed at the same rate as taxable income.

Other relevant costs = purchase or sale costs including renovations or marketing.

So, what’s best for you? Negative, Neutral, or Positive (Cashflow)

Gearing plays a vital role in property investment, and understanding gearing and cashflow is vital for ADF members to make informed decisions. Negative, neutral, and positive gearing each have their own advantages and disadvantages and in an ideal world, a well-balanced investment portfolio might contain each. Ultimately, choosing the best gearing depends on your individual circumstances and investment goals.

At Capital Properties, our experts work with you to thoroughly assess your personal financial situation, including your income, expenses, and ability to service loans. As well as determining your risk tolerance and long-term financial goals. We’ll help you evaluate the current property market and best potential growth prospects and understand the impact of negative, neutral, or positive gearing on your tax position.

Our mission is to make sure you have the knowledge, confidence and tools to successfully navigate property investment alongside your commitment to the Australian Defence Force for financial future security.

Loan coming off a fixed rate this year? How to prepare

How to prepare for coming off a fixed rate mortgage

As an Australian Defence Force (ADF) member, you should already be clued-up about the importance of having a solid financial plan. Whether you’re new to saving/investing or already have a great Post Defence Force Property Strategy, being prepared for contingencies is vital. And that means being prepared for adjustments in your mortgage arrangements.

If you’re one of the thousands of Aussies who were clever enough to get their hands on a low-interest fixed rate home loan in 2020/2021, you might be fast approaching the end of your fixed term. That’s likely to mean you’ll be adjusting from a mortgage rate of around 2% to somewhere between 5-7%. So, taking action now is a wise move.

In this blog post, the experts at Capital Properties explain what it means when your loan is coming off a fixed rate. And how to prepare for the end of your fixed term mortgage.

At Capital Properties we’ve helped thousands of ADF members to successfully invest in property for their future financial security. Attending our FREE Capital Properties Discovery Session is the best way to get started. And if you’re already making smart investment decisions, remember to take advantage of our Property Investment Tools & Apps and valuable Capital Properties Pinnacle Support Program resources.

On the go? Here’s 30 seconds of take outs:

- When a fixed rate period ends it’ll usually return to the current variable rate

- A rate jump of 2.00% to 5.00% on a $500k x 20yr mortgage costs $770pm more

- Use the Capital Properties Budget Planner to work out your budget

- Make extra repayments now, if possible

- Consider an offset account

- Compare other lenders rates with Canstar or lendi

- Investigate refinancing options at least 3 months before your fixed rate ends and negotiate a better rate with your lender

- Decide between a fixed rate, variable rate or a spilt-rate home loan

- A good mortgage broker will help you get the best deal

Keep reading >>

What to do with your loan coming off a fixed rate this year

First, let’s fill you in on what happens when your fixed rate period ends. If your fixed rate home loan expires before you take any action, it’ll usually return to the lender’s current variable rate. You should get a letter from your bank/lender explaining what’s about to happen, but you won’t usually have to sign anything, so many people just let it slide. Which is exactly what your bank wants, as your new rate will most likely be a lot higher than you’re used to and probably higher than other variable interest rates on the market too. Ignoring the increase is a costly mistake. For example, an interest rate jump from 2.00% to 5.00%, (based on a balance of $500k over 20 years), will cost $770 more per month!

So, the earlier you prepare for the inevitable, the better. Here’s our experts’ advice to help you find a better home loan deal with a more competitive interest rate when you’re coming off a fixed rate.

Start saving now

If you’re one of the lucky ones to have secured a fixed rate under 2%, you should have been laughing all the way to the bank for the past couple of years. Ideally, you’ll have made good use of that and will already have a nest egg (in a high interest savings account) to rely on. If not, it’s still not too late. We recommend working out what the new monthly repayments are likely to be when you come off the fixed rate and start factoring that into your payments now.

Then the work starts with really figuring out your budget. The Capital Properties Budget Planner is a great tool that makes this task easier. If the budget is looking tight, your next step to take is figure out where you can make savings. That might mean cutting back on non-essential spending for a while, paying off credit card debts and/or get on the phone and start negotiating for a better rate with your utility and insurance providers for example. Our blog post “5 top tips to start your savings plan” is a great place to start.

Make extra repayments

If you can, it’s wise to try and pay off as much of your home loan as possible before your fixed rate ends. Although many fixed rate loans have restrictions on making extra repayments, some will allow additional restricted repayments, sometimes up to $10,000 a year. So, again, get on the phone to your lender and ask what they’ll allow.

Reducing your home loan balance before the inevitable interest rate increase could save you heaps on interest payments and give you a decent buffer.

Consider an offset account

If the idea of a high interest savings account doesn’t appeal, or you can’t find one that offers a good enough rate, then it’s worth considering an offset account. This is effectively like a savings account that’s linked to your home loan which allows you to offset some of the interest you pay on your mortgage. That means, if you have a balance of $500k and you put $100k into your offset account, you’ll only have to pay interest on $400,000.

Again, there may be restrictions in opening an offset account on a fixed rate mortgage, but it’ll certainly be available on your new variable rate mortgage.

Get competitive quotes

If your loan’s coming off a fixed rate this year, there’s no obligation to stay with your existing lender. Now is the perfect time to do your research and compare other lenders rates to see if you can get a better deal. Use a service like Canstar or lendi to see what other lenders are offering, or find a good Mortgage Broker and get their advice.

Our blog post “10 questions to find the right mortgage broker for you” will help you identify what a good mortgage broker looks like. Or just call us on 1300 653 352 or email [email protected] and we’ll put you in touch with the best.

Let the negotiations begin

If you don’t ask, you don’t get. It’s amazing how many people forget that it’s possible to negotiate with your existing lender. But that one phone call has the potential to save you thousands of dollars a year. Tell them what you’ve found from your research of other lenders and ask your bank to match the best deals. Even if you have no intention of going with another lender, using the threat of the possibility of that happening is a useful negotiation tool.

Consider refinancing

If your existing lender won’t come to the party, then put that research you’ve done to good use and consider if it’s worth refinancing your home loan. Some lenders offer better loan features, e.g. cash-back deals and others will have lower interest rates or lower fees that could save you hundreds.

If your loan’s coming off a fixed rate this year, we’d suggest looking at your refinancing options asap – ideally around 3 months before. Although property values have started trending upwards again recently, it’s best to allow a buffer just in case your property does go down in value. The value is based on current comparable sales, and will last for 90 – 180 days, so if you start earlier, you’re giving yourself the best chance of getting the best valuation possible.

Remember to factor in any additional fees that might be associated with refinancing, such as application fees or legal fees. Especially if you decide to start the process early and want to roll-over to your new loan before your loan comes off the current fixed rate.

What to look for in a new home loan

If you decide that refinancing is the best option for you, it’s essential to negotiate the best deal possible. Consider if another fixed rate loan is better than a variable rate. Or would you prefer to have the opportunity to create an offset account and make extra repayments?

If you like the idea of the flexibility of a variable mortgage with the stability/predictability of a fixed rate mortgage, a spilt-rate home loan might suit you better. For example, with a split-rate loan, you could divide a $500k home loan into a 60% fixed interest rate and 40% variable interest rate, meaning $300k would be fixed and $200k would be variable.

Still not sure how to prepare? Ask an expert

If you don’t have the time or energy to research the home loan, or aren’t sure which loan is best for your circumstances, then we strongly recommend that you talk to an expert. A good mortgage broker will help you decipher the ins and outs of home loan refinancing. And, because they have access to deals that you couldn’t find elsewhere, they could save you lots of money on unnecessary fees.

Where to get help if you’re in strife

If you’ve found yourself in the position where your loan’s coming off a fixed rate this year and you think you’ll struggle to pay your higher mortgage costs, then don’t delay, get help asap. You can get in touch with your lender directly and ask to speak to their financial hardship team. They may be able to offer a temporary pause on payments, or payment reductions for a set period of time.

If you’re in Queensland or the ACT, the state governments offer subsidised mortgage relief loans in circumstances such as unemployment or illness.

The Capital Properties team is working with many of our clients to help them prepare for a loan coming off a fixed rate this year. And we’d love to help you make an informed decision about your next steps so you can navigate these challenges and set yourself up for property investment success.

As always, the Capital Properties Switched-On Strategy Series and Pinnacle Support Program are designed to support you at every step of the way on your home-owning and investment journey. Get in touch now to find out more.

Investing this year / Understanding the trends

Understanding property market trends

Thinking of investing this year? Understanding the trends in the property market will help you decide if property investment is a viable wealth building strategy for you right now. In this blog post, the Capital Properties experts will examine current market trends that have the potential to affect your property investment decisions.

The property investment specialists at Capital Properties share the key trends happening in the Australian property market right now. Our FREE Discovery Session will explain how these trends can impact your property investment decisions and help you work out if investing this year is the right move for you.

On the go? Here’s 30 seconds of take outs:

- Understanding the trends in the property market is vital for successful property investment.

- Capital cities had a record-breaking annual rental increase of 11.7%.

- Rental demand is driven by migrants, short-term visa holders & foreign students.

- Australia’s population will increase by 900,000 by 2025 stimulating further demand.

- Construction is under pressure – accounting for almost 1 in 3 insolvencies over the past year.

- Home values are trending higher – up by 0.9% since early March.

Keep reading >>

2023 – a landlord’s market

So far in 2023, Australian landlords have enjoyed historically high rental prices across most capital and regional areas. Post-pandemic house rents have risen for eighth consecutive quarters by 31.4% which equates to $135 a week. While unit rents have increased by 34.1%, or $140 a week. In total, the combined capitals enjoyed a record-breaking annual rental increase of 11.7% in the past year, mostly driven by increasing demand for capital city units.

And apart from Canberra and Hobart, capital city vacancy rates are still near record lows causing a rental crisis in some areas. We discussed this before in the blog post “Housing affordability/ rental crisis/ extremely low vacancies. What does it all mean?”

What’s driving high rental demand?

As a property investor, understanding the trends of the rental market is vital. Right now, rental demand is being driven mostly by migrants, short-term visa holders and foreign students, who generally search for more affordable accommodation in medium to high density housing, with easy access to amenities.

In the 12 months from September 2021 to 2022, Australia welcomed almost 304,000 new migrants. And the pressure on the rental market is predicted to continue with a projected 650,000 migrants arriving in Australia over the next two financial years. If you also consider births, it’s expected that Australia’s population will increase by 900,000 by 2025.

This high rental demand is obviously great news for investors as it usually means higher rental income. However, rental income isn’t the only reason that investors consider property investment. Even when high interest rates mean that the operational costs of managing the property could exceed rental income for a period, there’s always the obvious benefits of capital gains and negative gearing. As Eliza Owen, Head of Residential Research at Corelogic says; “Negative gearing exists to help investors purchase real estate and provide rental housing when operational costs of the property exceed rental income.”

High rental demand = more demand for property

The rental market has been under significant pressure for some time in Australia. And as rental demands increase over the rest of this year, the need for available properties will obviously continue to grow. Lower stock levels are also likely to place upwards pressure on home prices, according to CoreLogic research director Tim Lawless. “With rental markets this tight, it’s likely we are seeing some spill over from renting into purchasing, although, with mortgage rates so high, not everyone who wants to buy will be able to qualify for a loan.” says Lawless.

With growing pressure in city markets, it’s expected that rents will continue to increase, meaning that many people will consider purchasing in surrounding satellite areas and suburbs, creating further demand for improved infrastructure and new housing.

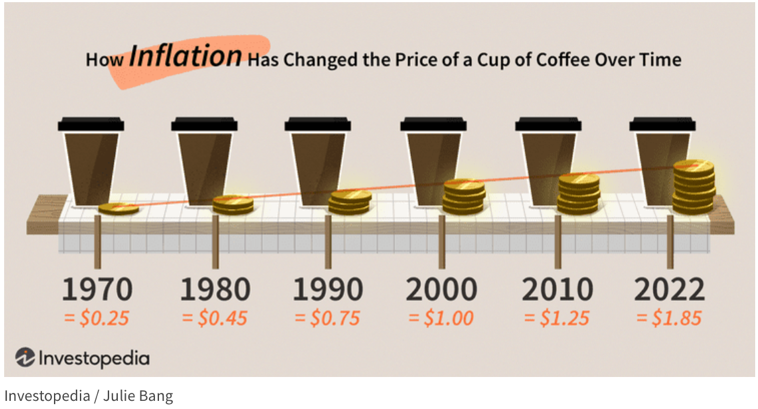

The effect of inflation and interest rates on housing

If you’re not sure of the correlation between inflation and interest rates, then it’s worth having a quick skim of our post “What is the relationship between inflation and interest rates?”.

Although inflation peaked in the December quarter 2022, the most recent rate hike [May 3rd 2023] demonstrates that the Royal Bank of Australia (RBA) is concerned that at 7%, it’s still too high. So, it’s no surprise that many Aussies are being financially cautious, having endured the most rapid rate hiking cycle on record.

The RBA notes that reduced household spending is due to “a combination of higher interest rates, cost of living pressures and the earlier decline in housing prices” – despite data showing a recent more positive housing trend.

Most economists agree that this rate hiking cycle is nearly over with the RBA expecting to reach its goal of 3% by mid-2025. In fact, recent figures show an improved confidence in the property market with stronger demand for housing. CoreLogic noted in mid-April that home values are starting to trend higher, lifting by 0.9% since early March.

Pressure on construction

The construction industry has also felt the effects of inflation. High inflation means higher material and labour costs. Coupled with delays caused by supply chain disruptions and weather events, builders have been left with impossibly slim margins. And there are less buyers as new homebuyers struggle to negotiate these higher construction costs as well as rising interest rates. Inevitably, this situation has led to an unfortunate increase in insolvencies in the construction industry.

The Australian Securities and Investments Commission (ASIC) reports that over 400 construction companies have liquidated since the start of 2023 with almost 1,500 insolvencies since July 2022. The RBA’s financial stability review estimates that the construction sector made up approximately 30% (I in 3) of all company insolvencies over the past year.

House prices stabilising

CoreLogic’s report on 30th April 2023 showed that each of the four largest capitals had a lift in values with the second consecutive monthly rise in national housing values. This demonstrates an improvement in consumer confidence and is presumably in response to the factors mentioned earlier – increased demand due to migration, tight rental conditions, and low available supply. All of which show no sign of easing anytime soon.

Some property investors who sat on the sidelines through the downturn are assuming that the market has bottomed out and are all set for investing this year. It’s certain at least that the market will level out when interest rates have finally peaked and improved consumer confidence will drive both purchasing and selling activity in the property market.

Should you consider investing this year?

As a Defence Force member you might be wondering if it’s worth investing in property this year as part of your wealth-building strategy? At Capital Properties, we recognise that property investment is a long-term strategy, so although understanding the trends is vital for well-informed investment, short-term circumstances shouldn’t deter you from making smart investment decisions.

Ultimately, the decision about whether it’s worth investing this year comes down to whether YOU are ready or not. Even in more challenging markets, there are opportunities and incentives for ADF members to take advantage of. And in some cases, it’s better to act sooner rather than later and risk missing out on a great investment property. Our blog post “Buying a house while in the Defence Force” explains some of these ADF incentives.

If this is your first time in the market, then we recommend you check out our “Defence force first home buyer’s guide.”

At Capital Properties, we work with ADF members to maximise your chances of success. It’s our mission to help you identify the best markets to invest in and find properties that deliver great rental yields with potential for capital growth, and the ability to weather changes in the market and economic downturns.

The Capital Properties free Discovery Session will guide you with everything you need to know on how to buy well for effective property investment.

Check out our FREE investor tools: Sign Up to Our Switched-on Property Investors Program | Your free online property investment toolkit