But it’s not as easy as it seems. Here we break down the what, where, when, why and how of small development project investments.

On the go? Here’s 30 seconds of take outs:

- Small development projects aren’t easy to execute, especially on your first go around. But if done right that can mean faster and bigger returns on investment than a standard ‘buy and hold’ strategy.

- The sweet spot for small development projects is in markets which allow an additional three dwellings to an existing house on the same block – yielding four dwellings in total. The Brisbane property market is ripe for these types of projects right now.

- You can proactively manage and minimise your risk by knowing the market and understanding your investment strategy inside out. And as a first timer your best approach is to team up with someone who has the knowledge and expertise to execute the development.

Keep reading >>

Small-scale development projects are perfect for proactive investors looking to exponentially grow their asset base and high household income earners looking for something outside the box to the standard type investments.

The accumulation of income-producing assets (aka property) is the reflection of a well-executed ‘buy and hold’ strategy. This is the strategy I have personally adopted, with great success. However, the key to successful execution is investing in multiple assets to diversify your risk. No one has a crystal ball to the future. Some investments will grow well while others may take a long time and it can be a long waiting game for the market to provide growth and increase your portfolio’s net worth.

Small development projects can give investors more control over the speed of growth. An investor can purchase a residential property to hold but manufacture growth by adding additional dwellings (but only as many as they can sustain at completion).

Getting into a position where you have the available equity and borrowing capacity is the number one hurdle to entering the small-scale development market. Once you’ve hit that point, there’s still a lot to know.

3 things everyday investors and first-time developers need to know

You can’t afford to make mistakes

Not having experience in this type of process means you’re vulnerable to making mistakes and you really can’t afford to get it wrong. Winging it isn’t a smart strategy. A measured approach is the way to go, because the market isn’t forgiving enough for investors to make big mistakes and first timers always make big mistakes!

The development process is costly

Development costs like council fees, construction costs, low gearing and high-interest rates have all increased noticeably over the last few years. The bottom line? Developing is expensive and it needs to be done right!

Time is an equaliser

Many successful developers start out by teaming up with someone who has walked the walk first. They share their returns, so they can learn the ropes from someone more experienced. Delivering projects well is a massive undertaking, and you are kidding yourself if you think you can do it on your own. It’s a full-time role and it’s all about leverage, in every sense of the word.

How to enter the small development market

The sweet spot for small development projects is in markets which allow an additional (minimum) two dwellings to an existing house on the same block – yielding three dwellings in total.

It’s worth noting that for this strategy to work in the targeted suburbs a house plus four future dwellings is the maximum sustainable yield. A house plus three future dwellings works even better with residential lending. For the best results with small development projects, a house plus three future dwellings is the way to go.

Which market works best for small development projects?

Right now, it’s Brisbane. Why?

Council zoning – Brisbane works well with this type of strategy because it is a smaller market with well-defined areas of required zoning.

Property cycle – Brisbane is operating in a different property cycle to Melbourne and Sydney, the growth has been slower but more consistent.

Our contacts – Through our network of partners we have great visibility and access to target properties. Real estate agents and vendors contact us because of the way we operate and off-market deals are common.

Our market knowledge – We know the market, at what price point to purchase and the end-product point of sale. The target suburbs within eight kilometres of the CBD are more attractive to owner-occupiers than investors. So producing the right type of finishing’s are super important to ensure the property meets the expectation of the intended markets; the skew is to owner-occupiers for their purchasing premium.

Market knowledge is key to getting the strategy right.

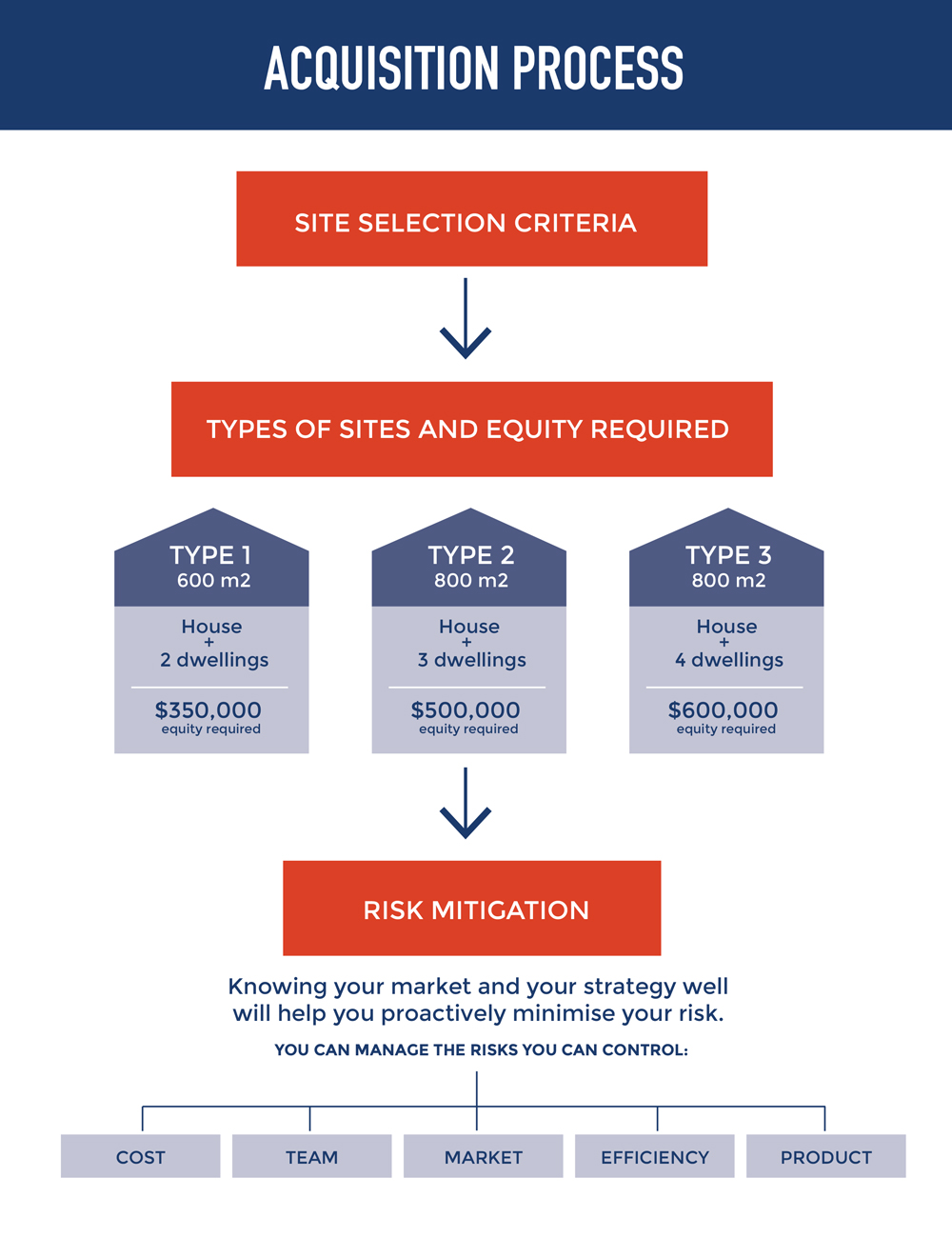

Acquisition process

Acquisition process

The site selection criteria

- Within 8 kilometres of Brisbane CBD

- LMR zoning

- No flood risks

- Access to existing infrastructure

- Flat block with a natural slope to the front of the street for drainage and aspect

- An existing house with good structural integrity

- 15 to 20 metre frontage, 6 metres from the front of the house to the front boundary, 3.5m width down one side, 22 metres from the back of the house to the rear boundary.

Types of sites and equity required

Type 1 – 600 m2

House + 2 dwellings – $350,000 in equity required

Type 2 – 800 m2

House + 3 dwellings – $500,000 in equity required

Type 3 – 800 m2

House + 4 dwellings – $600,000 in equity required

Expected return on investment (ROI)

*100% return – The aim will always be for a 100% return on equity. For example, if you put $350,000 equity in, the return is $350,000 in equity uplift.

*22% return on cost – The average is 22% return on cost. A 22% return on cost means your (net) profit was 22% of the total development cost of your project.

*6% gross yield – The average gross rental return is 6% once all rented out. For example, if your project valued at $1.3m the project would lease for $76,000 p/a.

*These figures are calculated from past project averages.

Risk mitigation

The best approach is to team up with someone who has the knowledge and expertise to execute the development. This will help you to achieve your planned investment objectives whether in the form of capital uplift or rental returns.

Knowing your market and your strategy well will help you proactively minimise your risk. You can manage the risks you can control:

Cost

Over capitalisation occurs all the time in development. The purchase price, consultant fees, design, construction costs etc can all blow out. It’s very easy for a developer to over capitalise and not realise it until the end of the project. And if it’s your first time you’re most likely in a new market or new product in the market. Market fluctuations are hard enough to navigate, without adding unnecessary additional risk.

Team

A reliable design, town planning and project management team means you can plan the time horizon for the project with confidence and accuracy.

Market

Our development projects are in Brisbane, within eight kilometres of the CBD. This radius is tight to ensure the end-product values are they need to be. For example, finished townhouses are valued to ensure ROI remains intact.

Efficiency

Our process is tried and tested over an 8-year period, it works and can deliver. Our time is spent on searching for efficiency, ways to continually improve the model.

Product

Small infill boutique townhouse development. Small 3 – 5 dwelling developments ensures minimum supply and maximum demand. A close radius to the CBD means most blocks have already been developed. So end values are more easily defined as there is a lot of precedence in the street.

Next steps

If this is something you’ve been thinking about, get some experts around you to help you on your way. With Capital Properties’ Pinnacle Support Program we can help you bring the next part of your growth strategy to life.

Get some experts around you to help you on your way: Pinnacle Program Support

Free investor tools: Online property investment toolkit | Book Your Pinnacle Program Review | Small Development Project Investments Flow Chart PDF