Once you’ve identified a metropolitan area as having sound property investment fundamentals and a current median house price that fits your affordability range – it is time to dig deeper into specific locality data. We call this the micro criteria of choosing an investment property for capital growth.

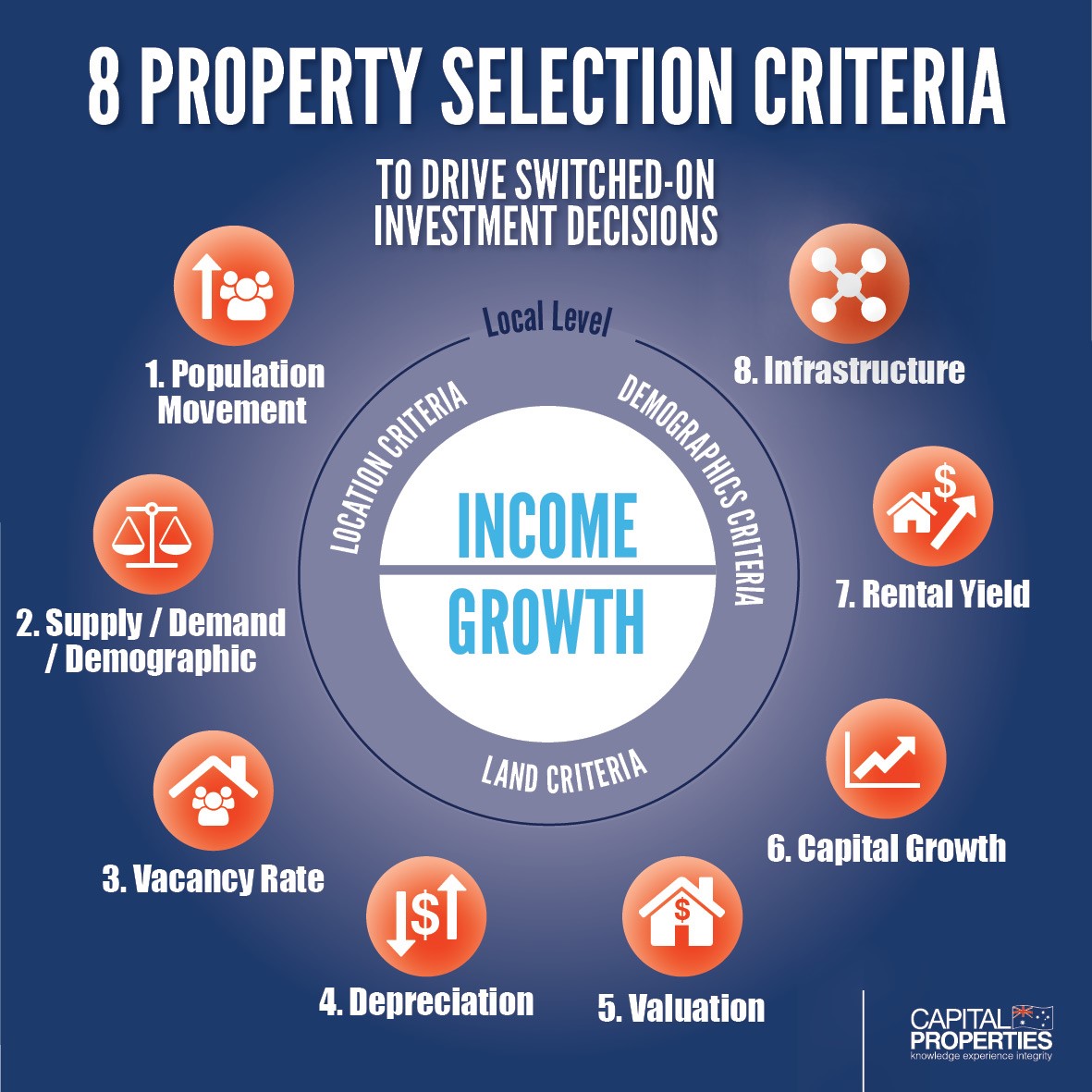

We’ve collectively brought together decades of experience and condensed it into 8 property selection criteria to help you on your way to success.

It will save you days of trawling search engines for magic solutions that don’t exist.

On the go? Here’s 30 seconds of key take outs:

· Use this proven check list to guide your strategy. You’re heading in the right direction.

· Simplify your choices and save time by using investment criteria backed by research.

· Property investment is head over heart – base your decisions on objective data, put emotion aside.

· Reach out to professional support to optimise potential returns and continue learning.

Keep reading >>

8 property investment selection criteria

Property selection criteria #1: Population Movement

Tip: Current data shows moderate population growth

Moderate population growth will tie into planned infrastructure projects, because as the population swells infrastructure will need to scale up to support this population growth.

Take caution in localities where population growth is constrained and could potentially decline because the urban infill has already taken place. A built up, mature property market isn’t always a great investment area if population growth has hit capacity.

Property selection criteria #2: Supply | Demand | Demographic

Tip: Look at housing supply and demand, and demographics

Housing supply is driven by land availability, construction costs and profitability for developers. For infill, brownfield or greenfield developments infrastructure costs such as water, power, sewerage and public transport will impact housing supply.

Housing demand is driven by the number and type of households looking for housing. Household income and preferences like house size, location and preferred type of tenure; along with current interest rates also drive housing demand. [Source: https://federation.dpmc.gov.au/supply-demand-and-government-involvement-housing-market].

Consider the demographics of the area. That is, the characteristics of the local population such as age, employment status, gender, education status and family income bracket.

By designing a new build to attract the demographic that is driving housing demand, you’ll attract good quality, stable tenants for long tenures.

Property selection criteria #3: Vacancy Rate

Tip: Look for a low vacancy rate and high rental demand on purchase

Vacancy rates can vary over time. For this reason, monitor vacancy rates on a regular basis and never consider vacancy rates in isolation.

Around 3 percent is a normal vacancy rate.

The percentage will give you an indication of the type of supply and demand for rental properties in the location you are considering.

Property selection criteria #4: Depreciation

Tip: Consider new or near new properties to depreciate and minimise your tax bill

The government incentivises new construction through tax deductions to cover depreciation. Depreciation is the wear and tear on a property that has been bought for income producing purposes.

You can claim the depreciation of your investment property against your taxable income at a much higher rate than older property. Minimise your tax bill by investing in a new residential construction in an area that meets the criteria on this check list.

Property selection criteria #5: Valuation

Tip: Get a good valuation

If you’re looking for finance to fund your next investment, you need to make sure you get a valuation near or ‘On the mark’ – at contract price or more. Without a good valuation all of this falls down because many investors with low valuations may not have funds to complete the purchase, everything hinges on a good valuation.

Once you have an investment property for a while, a valuation at the higher end of the ‘range’ – what you think its worth, will in turn give your bank or financier confidence to lend you the funds you need to build your investment portfolio and achieve your goals.

Property selection criteria #6: Capital Growth

Tip: Market averaged capital growth between 3 to 9% per annum

The idea here is not to invest in an area that has already boomed or just about to – that is risky.

Invest in a location where data shows steady market growth. As with the market overview criteria for choosing an area, look for market averaged growth between 3 to 9 % per annum also.

This steady range will protect you from buying in to an overvalued market. ‘Proven potential’ is the key criteria to look for.

Property selection criteria #7: Rental Yield

Tip: Rental yields of between 4 to 6% show good returns based on steady areas.

Rental returns of at least 4 – 6 percent will give you enough income to support the investment property purchase.

Property selection criteria #8: Infrastructure – Planned | Existing – Private | Government

Tip: Infrastructure scaling up to support population growth

Infrastructure is structures or facilities needed to support a local population. Infrastructure can be planned or in construction, already existing servicing the local area, and be funded via private companies or by the government.

Examples include: shopping complexes; convenience stores; retailers; public and private transport – including buses, trains, and the freeway and road networks; hospitals; medical services; schools and child care facilities; and recreational and sporting grounds and facilities.

What you’re looking for is evidence of sufficient existing infrastructure, but importantly – planned investment in government funded and private investment infrastructure projects over the short and medium term. A portfolio of infrastructure projects in plan mean that government and private sector investors have confidence the area is a growing corridor.

Keep focused on the big picture

You simply can’t look at any of the criteria above in isolation. You need to overlay multiple factors to gain a clear view of the longer term capital growth opportunity. Remember, you need income producing assets to fund the lifestyle you’re aspiring to enjoy earlier, rather than later.

Get some experts around you to help you on your way.

Free investor tools: Property Selection Criteria PDF | More Switched-on Strategy Series