Has US inflation peaked?

You may have heard talk last year about when and where US inflation would stabilise. Followed by headlines at the beginning of 2023 confirming that US inflation peaked in December 2022. Now, the question economists are trying to answer is how far, and how fast inflation will come down.

In this post we’ll answer the question, “what is inflation?”, explain the different types of inflation and how we measure inflation. Then, most importantly, we’ll explain what the current inflation rate means for Australia and the property market, now and in the near future.

If you’re interested in property investment as a way to build wealth and secure your financial future, then Capital Properties can make sure you’re on the right track. Book our FREE Capital Properties Discovery Session to get started.

Already on board? Don’t forget to take advantage of our Property Investment Tools & Apps and essential resources from our Capital Properties Pinnacle Support Program.

On the go? Here’s 30 seconds of take outs:

- Inflation is the rate at which the prices for goods and services rises.

- When inflation is ‘high’ you get less for your money.

- The 3 types of inflation are demand-pull, cost-push & built-in inflation.

- We measure inflation using the Consumer Price Index (CPI) & the Wholesale Price Index (WPI).

- Inflation can be caused by many factors such as increased demand for goods & services, supply chain disruptions, natural disasters & government stimulus spending.

- US inflation matters in Australia because it effects our exchange rate – which effects overseas investors.

- Property investors recognise that inflation can raise the value of their assets.

- It’s predicted that the inflation rate will gradually reduce toward the 2-3% target by the end of 2024 & drop to 2.5% in 2025.

Keep reading >>

What is inflation?

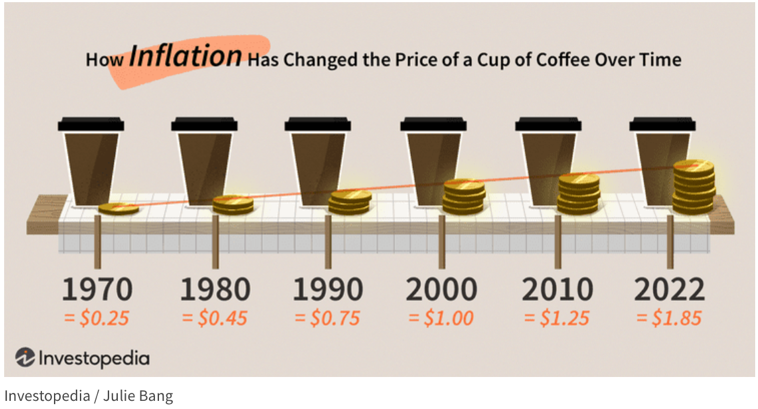

It’s important to understand what inflation is and how it affects the economy. Inflation is the rate at which the prices for goods and services rises. Inflation has always fluctuated over time. In a healthy economy, there’s a gradual rise in overall price levels over time. That allows for moderate long-term interest rates, stable prices, and high employment rates. This ideally coincides with increasing wages, so people don’t have to be too concerned about increasing prices.

However, when inflation is ‘high’ the cost of goods increases so that your money effectively buys less. In these circumstance people become more careful with their spending which leads to a decrease in consumer confidence and result in slower economic growth.

Negative inflation, aka “deflation” is a sign that the economy is struggling and can potentially lead to a recession or depression.

Three types of inflation

Inflation can be classified into three types:

- Demand-pull inflation happens when the supply of money in the economy is increased. This boosts customer confidence and the demand for goods and services extends beyond the economy’s production capacity. This surge in demand then leads to price rises.

- Cost-push inflation is a type of inflation caused by increases in the cost of important goods or services where there’s no other alternative available (key commodities). When businesses have to pay higher prices for underlying ‘inputs’, they have to increase prices of their ‘outputs’ for their customers. For example, when the cost of oil goes up, the customer has to pay higher energy prices.

- Built-in inflation occurs when people anticipate that the price of goods and services will go up in the future so their demand for goods and services increase. As a result, the cost of the goods/services increases and workers demand higher salaries to maintain their standard of living. This is known as the wage-price spiral.

How do we measure inflation?

Here in Australia, there are 2 main measures of inflation. The Consumer Price Index (CPI) and the Wholesale Price Index (WPI).

- Consumer Price Index (CPI)

The most well-known indicator of inflation is the Consumer Price Index (CPI). The Reserve Bank of Australia defines CPI as a tool which “measures the percentage change in the price of a basket of goods and services consumed by households”. In Australia, the Australian Bureau of Statistics (ABS) calculates the CPI and publishes the data every quarter.

- Wholesale price index (WPI)

The wholesale price index (WPI) measures the overall change in the price of products (goods and services) as they leave the place of production or as they enter the production process – i.e. before they reach consumers. In the U.S. the WPI was renamed the Producer Price Index (PPI).

In the US, inflation is also measured by Personal Consumption Expenditures price index (PCE) which comes from surveys of businesses that measure their customers spending on goods and services. The Federal Reserve (the US central banking system) prefers to use the PCE to measure inflation as it doesn’t rely on the more volatile food and energy prices.

What can cause changes in inflation?

In recent years, inflation has been rising steadily, here and in the US, due to a surge in demand for goods and services after COVID-19 lockdowns, government stimulus spending and supply chain disruptions. However, by December 2022 the rate of inflation in the US had started to slow down, leading some economists to believe that it may have peaked. We say “may have” because although we do our best to use the measures above to predict what’s happening with inflation, it’s far from an exact science.

There are many other factors can cause changes in inflation. For example, natural disasters such as the 2022 floods here in Australia drive inflation as they result in higher prices in agricultural products (e.g. fruit & veggies) due to disrupted supply chains. And, in March 2023, the global banking system reeled from the collapse of Silicon Valley Bank, Signature Bank and a potential failure of First Republic bank and Credit Suisse. This caused stock markets to wobble and consumer confidence to fall.

So, it’s prudent for us to keep an eye on the US market and ask if US inflation peaked. And what does that mean for Australia?

Why do we care about inflation in the US?

Although the Australian economy is not directly tied to the US economy, there are a few ways in which US inflation could indirectly affect the Australian property market to impact Australian property investors.

For example, in the exchange rate, if the US dollar strengthens as a result of decreasing inflation, this could lead to a stronger Australian dollar. That could make Australian property investments more expensive for foreign investors. On the other hand, if the US dollar weakens, it might make Australian property investments more attractive to foreign investors.

US inflation could also impact the Australian property market’s interest rates. If inflation in the US continues to decrease, it’s likely to lead to lower interest rates in Australia. And lower interest rates equal easier access to financing for property investments. However, if inflation in the US starts to rise again, then we could potentially face more interest rate hikes.

Plus, when the US suffers the collapse of banks, as seen in March 2023, then Australian banks have a harder time convincing Australians that their money and investments are safe. And people are naturally likely to become more cautious about borrowing and investing.

Are there up-sides to high inflation?

In the past, we’ve seen that the top of an inflation cycle was a great time to enter the property market. And many property investors are happy to see some inflation as it raises the value of their assets. As long as they’ve planned for increased mortgage interest repayments and have a rental yield covering those costs.

In the past, we’ve seen that the top of an inflation cycle was a great time to enter the property market. And many property investors are happy to see some inflation as it raises the value of their assets. As long as they’ve planned for increased mortgage interest repayments and have a rental yield covering those costs.

Inflation for 2023 and beyond

In the US, the unemployment rate is at a multi-decade low. The gross domestic product (GDP) has steadily grown and is expected to reach 23618.00 USD Billion by the end of 2023, leaving it in a strong economic position and still celebrated as the world’s largest economy.

In Australia, our GDP in Australia is expected to reach 1571.00 USD Billion by the end of 2023, to potentially become the world’s 12th largest economy – up one from our current 13th position. Coupled with an historically low unemployment rate, the future looks stable – if not bright!

And after a year of aggressive interest rate hikes, the Reserve Bank of Australia has predicted that the inflation rate will gradually reduce toward the 2-3% inflation target by the end of 2024. And Trading Economics models have predicted that they’ll drop again to 2.5% in 2025.

Overall, while the recent peak in US inflation may have some indirect impacts on the Australian property market, it’s important to remember that there are many factors that affect property prices. And remember that no one can predict the future with absolute certainty.

Fortunately, the experts at Capital Properties have been around long enough to have negotiated inflation changes many times before. And despite these challenges, they’ve helped thousands of ADF members to successfully invest in property for future financial security.

If you’re interested in property investment, it’s important to do your research, seek advice from professionals, and make informed decisions based on your own financial goals and circumstances.

Our Capital Properties Switched-On Strategy Series and Capital Properties Pinnacle Support Program will make sure you’re able to successfully navigate these changes in the Australian property market.