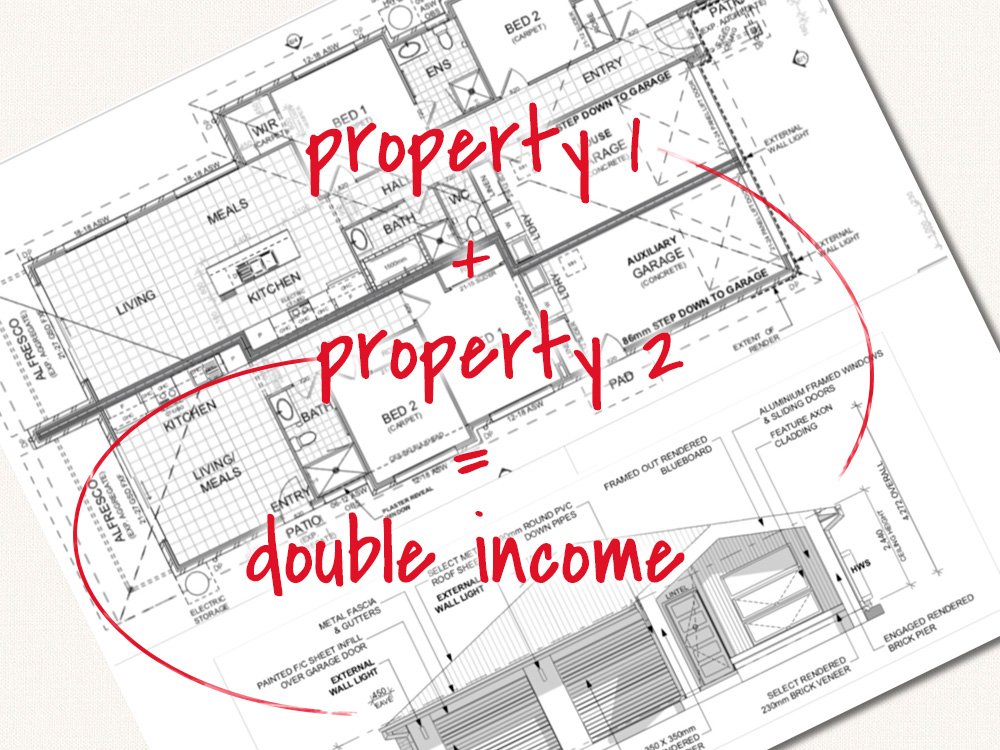

Doubling your income might sound like a pipe dream, but with a popular two for one property – the dual key – it’s achievable.

Find out why these investments are a great option for Defence Force owner occupiers and investors.

On the go? Here’s 30 seconds of take outs:

- Dual key properties can provide the potential to double income and can be a smart choice for both owner occupiers and investors.

- However, dual key properties come with some restrictions and downfalls that are important to know before you take the next step.

- Duplexes may be an alternative option to explore if maximising both returns and long term equity is your goal.

Keep reading >>

The dual key is the double barrel shotgun of the property world. Two separate dwellings, two separate water and power meters but just one lot of rates notices.

You can think of it like a house with a purpose-built granny flat.

In essence, holding a dual key investment is like owning two separate homes on a single block.

Who should consider a dual key investment?

Dual income properties are ideal for Defence Force owner occupiers looking to tap into Defence Force property buyers entitlements while also receiving a rental income. Entitlements include:

- Defence Force First Home Owners Grant

- Defence Home Owners Assistance Scheme

- Home Purchase Assistance Scheme

Dual key investments are also ideal for Defence Force property investors seeking higher rental returns.

Dual keys are also the smart choice for growing families that need flexibility. They can meet a range of needs like caring for ageing parents or kids who just won’t move out!

What you need to know about dual keys

Dual key properties are only permitted in certain council areas in Queensland and New South Wales, and Perth where the zoning allows and where they can be built on average sized blocks. (There is a lot more to it, let us take care of that!).

While dual key properties can increase cash flow, they may be trickier to sell. The buyer market for dual keys can be limited unless you make modifications.

Unlike the common characteristics of the dual key’s cousin the duplex (see more info below), dual key properties share a common driveway by the two groups renting but (ideally) have two separate garages. The property may have only one front entrance for the main residence and the auxiliary unit may be on one side.

Some dual-key properties have one common area or back yard, but it is naturally better to have a fence running between the common area giving each tenant their own space.

How much do dual keys typically cost?

Dual key investments can start from *$450,0000 and rents returns can be *6.7%.

*Estimates only

The going deposit for many investors is at the writing of this article 12% plus costs (including, stamp duty, legal and bank fees).

Depending on your situation you might be eligible for the first home owner grant (FHOG) and stamp duty exemptions, which might help reduce your deposit and costs.

Example deposit calculation

Purchase price = $450,000

12% deposit = $54,000 – $15,000 (transfer duty estimator for FHOG Queensland)

Total deposit = $39,000

Example costs

Stamp duty = $0 (first homeowner Queensland)

Bank fees = $1,500

Legal fees = $1,500

Total costs = $3,000

Example total deposit calculation

Deposit $39,000 + costs $3,000 = $42,000

Investor tool: Deposit and cost calculator

Duplexes as alternative investments

A duplex is a residence of two homes. It’s a single structure with a common central wall, but usually separate driveways, gardens and other features you’d expect from a normal home. Unless the land has been strata titled the two homes exist on one land title.

With a duplex you essentially create two properties on two separate titles from which you can later sell one and retain the other – or keep both to enjoy the benefits of two incomes.

Duplexes can be a great alternative investment to help you achieve the goal of doubling your income while also providing potential equity up lift when constructing. Duplexes can provide opportunities for investors to maximise the potential of the land without having to subdivide.

Duplexes can have better resale potential as they have the flexibility of selling one without the other.

Where to next?

Whether you have an investment strategy in mind, or you need help finding a way to achieve your dreams, Capital Properties is here to help.

Send us an enquiry to see case studies mention Dual Key & Duplex Case Studies in comments box.

Check out our range of free property investment tools and resources or get in touch today.