In this article, we cover some of the basics of understanding a contract and what you need to do before you sign.

On the go? Here’s 30 seconds of take outs:

- Always get a licenced conveyancer or solicitor to review any contract before you sign.

- Read your contract and understand the basics, including any special clauses and conditions that exist.

- Need time to get your deposit and finances in order? Forward registration for new building contracts could be a good option to consider.

Keep reading >>

Congratulations if you’ve reached this stage of the exciting journey ahead. Straight up, I am not a licensed conveyancer or solicitor but I have had some help putting this information by our legal team (Details mentioned at the bottom). In this article I’ll share what I know but keep in mind I always, always recommend bringing in a licensed conveyancer or solicitor to review your contract before you sign.

What is an Expression of Interest (EOI)?

If you’ve completed all your homework and have found the property that is going to help you reach your goals, you can use an EOI to secure it with minimal risk. An EOI may call on you to pay a small, refundable deposit ($1K to $5K) and it is non-binding. That means if you change your mind, you can verbally cancel the EOI.

How do I cut through the legal speak and jargon of a contract?

Once you enter into an EOI, you’ll have around ten to fourteen days to do your due diligence before signing. To formalise the purchase of a new investment property you’ll be asked to enter into one or two contracts.

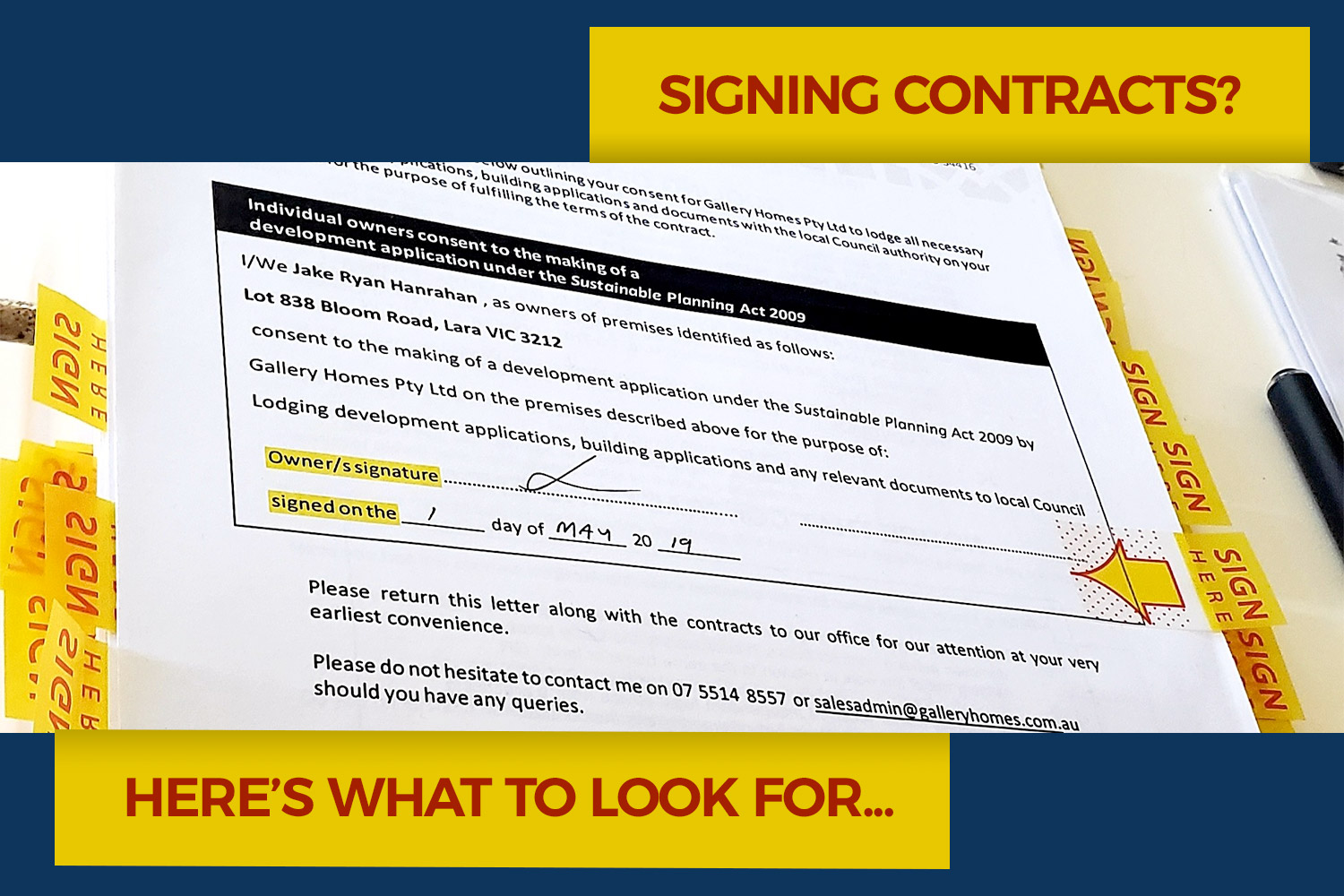

Contracts by nature are hard to read and full of legal jargon. It’s a good idea to read through them regardless, but always get advice from a licenced conveyancer before you sign! If you have the contracts checked by a solicitor or conveyancer first, you waive the cooling off period.

#StandEasyTip 1 – Understand the property contract basics

Here are some basic checks you can consider when you sign the contracts.

Complete and check the:

- Full details of the property, including address and lot number

- Spelling of your name, making sure you provide your full name

- Correct, full name of your estate agent if you’re using one

- Correct, full details of legal practitioners or conveyancers that you have engaged

- Contracted land price

- Deposit amount you’ll need to arrange to pay

- Inclusion of any special conditions, such as subject to finance clauses.

- Sunset clauses.

What does a land contract cover mostly?

Land contracts vary from state to state. Most land contracts cover:

- Details of the offer

- Acceptance

- Disclosures

- Estate covenants and caveats (building design rules)

- Development approvals.

What special conditions or clauses are helpful to have in the contract?

In the first couple of pages on most land contracts, you may find a finance clause. It may state that finance is or is not applicable or that the contract may be subject to finance.

Subject to finance means that if you signed the contract but your loan request was declined, you can get your deposit back with a letter from the financier.

Most real estate contracts are binding. This means that if you sign the contract you will be bound by law to fulfil the terms and conditions of the contract.

A wise exit strategy prior to agreeing to the contract is to include a ‘subject to finance approval’ clause. You don’t want to risk losing that hard-earned deposit if financing falls through.

Sunset clauses, what is a sunset clause? Using a sunset clause with an off the plan investment involves setting a time frame for the property to be built – most are 18 months. It’s been the case where we have had to try renegotiate the sunset clauses to a set date in offer of an unconditional contracts.

What do I need to know about a domestic building contract?

Your building contract will include targeted design and finishes for the target tenants – plus the building plans and a detailed list of specifications.

Make sure your builder has included all the details of appliance make and models, fittings, fixtures and finishes. Progress payments and warranties will also be detailed in the building contract.

#StandEasyTip 2 – Get in the market earlier with forward registration

If you want to start your property investing career but need three to six months to get the money together for settlement, forward registering is a good strategy.

What is forward registration and why should I care?

Forward registered land means the land is available for sale even though it hasn’t yet been registered with the Land Titles Office. This is because the developer may still be dividing the land into blocks or services such as footpaths, water, power, roads and curbing aren’t in yet. Once the land title is gained a building licence is issued and construction can kick off.

With forward registration you can secure a block of land for up to twelve months for a small deposit. This gives you months to get your affairs well in order and secure finance with a lender.

Forward registration is great when the property market is running hot and the availability of titled land is low. Just keep in mind, vacant land can increase in price between different stage releases.

What does that all mean for you?

You can lock the price in today, for a future settlement later.

#StandEasyTip 3 – Go fo fixed-price lump sum building contracts

Agree on a fixed-price lump sum building contract so that there are no surprises for you along the way. I also recommend a guaranteed timeline for starting the build and finishing construction.

#StandEasyTip 4 – Know your building contract

Your building contract is an important stack of paper. It can make the difference between a poor quality build and one that attracts reliable, respectful, good quality tenants.

It also gives you assurance of no surprises – you know exactly what you’re getting for the price upfront. Give it lots of attention, and an expert look over by a legal eagle before you sign.

Don’t fall for a cheap marketing hook. Some builders will advertise cheaper construction prices to lure you in. In building, you truly do get what you pay for. Cheap construction attracts cheap tenants.

To attract cash flow you need a well-designed, quality property that attracts good tenants. But not over the top with the specifications – no chandeliers and four metre high ceilings! If you sell down the track, the resale potential will be far greater if the build quality is evident.

This is something I overlooked on a deal or two and my returns were affected. Learn from my mistake!

Brandon McKenzie | Sabdia Lashand – Assisted in writing the article

www.sabdialashand.com.au | [email protected]

Click on the Capital Properties links below to find out more: Schedule a Free Discovery Session | Property Investor Workshops

Free investor tools: Sign Up to Our Switched-on Property Investors Program | Your free online property investment toolkit