In this article I share two simple ideas to help first-time investors get into the property market with little to no deposit.

On the go? Here’s 30 seconds of take outs:

- Lenders will look at your ability to repay your home loan and the size of your security deposit when assessing your home loan application.

- A family member can use their home equity to help secure your loan if you don’t have the full deposit needed.

- Immediate family members can also give non-refundable cash gifts that can be used as a deposit for your home loan.

Keep reading >>

Before we jump right into how to enter the market if you don’t have enough money saved for a deposit, let’s look at what lenders actually look for in home loan applications.

What lenders look for

Mortgage lenders assess a range of factors when granting home loans, but what it boils down to is:

- The applicant’s ability to service the loan (calculated using the debt to service ratio); and

- Whether the applicant has an appropriate security deposit (calculated using the loan to value ratio).

Loan serviceability – the debt to service ratio (DSR)

The debt to service ratio calculates the percentage of a borrower’s income that will be used to repay the home loan. To put it simply, the DSR tells a lender whether a borrower can afford the loan.

The basic debt to service ratio calculation is:

(Annual Mortgage Payments + Property Expenses + Other Debts Payments) / Gross Income

Lenders will often use a higher interest rate, called the assessment rate, to work out the mortgage repayments. This provides a buffer that takes into account fluctuations in the interest rate over time.

Your mortgage broker will help you calculate your DSR and should be able to give you a detailed breakdown of what’s included.

Security deposit – loan to value ratio (LVR)

The loan to value ratio is the amount you are borrowing as a percentage of the value of the property. A 95 percent LVR means you are borrowing 95 percent of the value of the loan and contributing five percent as a deposit.

But, why do I even need a deposit?

Lenders use your deposit as collateral against your home loan, so if you stop making your loan payments they can seize your deposit to recoup their losses.

How much money do I need to save?

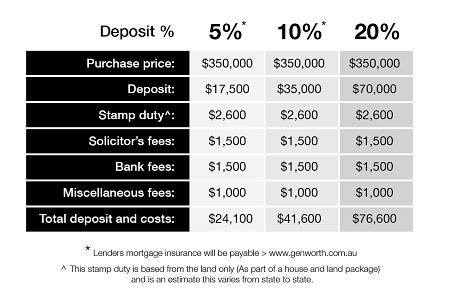

As a first-time investor, banks will only lend you money if you have between five and 20 percent of the purchase price of the home in genuine savings.

At a minimum, you’ll need to save around ten percent of the purchase price of the property to get started as an investor. Five percent will cover the minimum deposit required to secure your home loan and the remaining five percent will cover the additional fees.

The more you save the better. Not just because you’ll pay less interest over time but because with a deposit of twenty percent or more you won’t have to pay lenders mortgage insurance.

How to get in the market sooner

If you’re a first-time investor you’re probably wondering how on earth you’re going to save enough money to secure a home loan. With median house prices in Sydney hovering around the $800,000 mark you’re looking at a minimum $80,000 in the bank just to get started. But there are alternative options to explore.

The family pledge or parental guarantor loan

With family pledge or parental guarantor loans a family member, usually your parents, use their home equity to help secure your loan.

Say you want to buy a home for $500,000 and you have little or no savings. In this instance, your parents could offer a pledge of $125,000 against their home as additional security. The bank now has a total security for the loan of $625,000, making the loan ratio 80 percent. This means lenders mortgage insurance doesn’t apply. You must be capable of servicing the full loan of $500,000 as your parents’ income doesn’t count towards your debt to service ratio.

You can release your guarantor over time as the value of your property increases. But you do need to be aware of the limitations. If your parents are planning to sell their home it can be difficult to release their security.

It’s also important to note that most lenders require the guarantors to be employed, although in some cases lender will accept guarantor arrangements from retired family members. Guarantors should seek independent legal advice to make sure they understand their responsibilities and are fully aware of any risks involved.

Gifted deposit home loan

If your parents, or other family members, are in a position to gift you the money required for a deposit you can enter the market with little to no deposit.

You’ll need evidence to say that the money was a gift and it doesn’t need to be repaid. A gift letter that is signed by your parents will suffice as proof for most lenders.

Make sure you understand the rules around gifted deposit home loans as some lenders require that the funds are held in your account for three months before you apply for your loan.

Before you start thinking that having a home loan deposit of 20 percent or more is out of reach, consider your options, entering the property market might be more achievable than you think.

Guest Blogger: Brian Beck | Mortgage and Financial Consultant

[email protected] | www.quickselect.com.au

Free investor tools: Online property investment toolkit | Need a financial health check on your loans? | Get into the property market with little to no deposit PDF