So how do you cut through all the noise to find practical online information and tools that can put you on the right path to a secure financial future?

With years of experience under our belts, we can point you in the right direction!

On the go? Here’s 30 seconds of key take outs:

-

- When it comes to making a start in investing in property, you need to understand the big picture. That is, what your big picture framed by your lifestyle goals looks like, and the big picture that is the property investment market.

- Just like studying for a new career, or trade, you need to do your research when it comes to getting started in investing. There are loads of online promises of property investment advice but where do you start?

- You can make a start in property investing through online research, but having a few conversations with experts in the field will save you a lot of time and frustration.Keep reading >>I’m a strong believer that a few conversations with an experienced property investor will get you supercharged on the freeway to your longer term goals by guiding you via the most efficient route.The online research path, if you’re not sure where you’re heading, can be more like taking the scenic route where distractions seem to make your destination unreachable.I’m going to make it easier for you by combining the two. From an experience property investor here is your personalised online property investor kit.Free online property investor tools to help you zoom out before you zoom inBefore you target your sights in on your destination, you need to look at that big picture and start planning your property investment journey. Here are some online tools that will help.Investor tool: 7 step process to successfully invest in propertyStart your online research with understanding the overall process you’re about to step through. This one page process will give you a clear overview of where to start. Download the PDF and save it in a brand new file folder named ‘My financial future’ or words to that effect to keep you motivated toward your goals.You’ll find it here – Capital Properties > Investor tools and apps > 7 step process to successfully invest in property.Investor tool: Goal setting using mind mappingSetting lifestyle goals is an integral part of property investment. There is an old saying that goes:“If you think it, ink it!”This pretty much sums up goal setting. You need to flush out all of your thoughts and ideas to paper. The best way to do this is through a mind mapping process.Mind mapping is a great exercise to get your imaginative juices flowing and get your ‘think to ink’. Get yourself into a helpful state of creativity. By this, I mean grab a pen and paper or tablet and go to a comfortable space where you can simply focus on your creative mind.Then, dream out all your goals, now and in the future. Break it down into say, 1 to 3 years, or stretch yourself to imagine where you could be over the next to 10 years. Write them down as you go. Then – and this is where the creativity comes in – think about anything that could be related to each goal, write it down and connect it with a line. For example, one goal may be to live by the beach in 5 years time. Connected to this may be surfing every day and having a pet dog that loves the water. Do you want to be living alone, or with a loved one? Great! Write it down. Then keep going.

Reaching your goals won’t happen overnight but if you’re devoted to getting into the practice of committing your ideas and goals to paper, and stick with it long enough – you’ll succeed.

Here’s where to find some good online advice on how to set goals through mind mapping:

Capital Properties > Blog > Property investors squash distractions by setting goals

And here is a free online desk top application to help you mind map if paper and pen doesn’t do it for you:

Once you’ve got your goals committed to paper or in your new online file folder, it’s time to turn your goals into action.

Free online property investor tools to help start zooming in on your goals

Now that you understand there are a number of steps involved in the property investment process and you’re clearer on what your lifestyle goals are over the coming years, it’s time to start taking action to move toward them.

Online investor tool: tracking progress toward reaching your goals

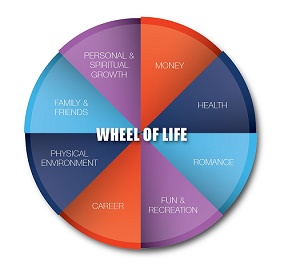

Transfer the goals your mind map helped you identify into the many different facets of your life:

- Career

- Family and friends

- Fun and recreation

- Money and finances

- Personal and spiritual growth

- Professional growth

- Health

- Physical environment.

Commit a couple of hours in your calendar regularly – at least once every six months – to review your goals and how you’re tracking toward reaching them

Here’s where to find a helpful online template to record your goals and update regularly:

Capital Properties > Investor tools and apps > Brainstorm your lifestyle goals

Learning how to identify your goals and monitor progress toward reaching them will help you become a better investor. Exploring your commitment to reaching your goals will also help determine whether you’re ready to take the leap into investing!

Online investor tool: property and your personal spending budget

Feeling motivated? Now it’s time to get some clarity on your current financial situation so you can start your investment plan.

Investing time to sit down and do a budget is a necessary starting point to get you a step closer toward your goals. If you’re not prepared to take this step, you’re not ready to start investing.

Here’s a free online template to get you started:

Capital Properties > Investor tools and apps > Your property and personal spending budget

Online investor tool: Build out your strategy

I’m not going to go into detail here, because you’ll find it all in this five minute read:

Capital Properties Blog > Switched on Strategy Series 3

You’re now on your way.

Online investor tools: compare interest rates on home loans

Now that you’ve set some goals the only way to achieve them is to start leveraging your money through smart investment.

Getting into the property market you’ll need to dive into the world of financial lending because you’ll need to finance your property investment. You’ll need to talk to a few banks or mortgage brokers.

Mortgage brokers do a lot of leg work in bringing the best loan options straight to you. Finding a good broker can save you a heap of time in having to talk with a bunch of banks, and then comparing ‘apples with bananas’ and be left scratching your head as to which is the best loan available to you.

However, if you’re keen to do a bit of leg work and explore your loan options, here are a couple of tools to help you research home loan interest rates and lenders mortgage insurance:

Compare interest rates on home loans

Canstar > Home Loans

Work out lenders mortgage insurance (LMI) estimates

Genworth > Online tools, forms and reports > LMI tools > LMI Premium Estimator

Online investor tools: market research

How is the property market performing on a macro level?

Capital Properties > Resources and tools > Free Australian Property Market Report

How to do your basic research on a national scale (5 minute read)

Capital Properties’ Blog > Switched on Strategy Series 1

How is the property market performing on a micro level?

Once you’ve narrowed down your target market at a State (macro) level, you’ll need a local area check list to help you identify an area. Here you go:

Capital Properties > Resources & tools > Investor tools & apps > Property Selection Criteria; and on our blog page > Switched on Strategy Series 2

Free monthly property market report

Herron and Todd White property valuer’s free monthly report identifies the latest movements and trends for property markets across Australia:

Herron and Todd White > Month in review

Current property vacancy rates

To help you identify where there is good rental demand indicated by low property vacancy rates, SQM Research offer this free online tool:

SQM Research > Vacancy rates

Online investor tools: managing your investment once it’s up and running

Get ready for tax time

This online calculator will help you get organised for tax time. It also acts as a real-time cash flow of your investment property:

Capital Properties > Investor tools and apps > Rental Property Worksheet

Rental management tips

Capital Properties’ Blog > How to keep good tenants; and How to deal with problems with tenants

How to deal with problems with tenants:

Insurance tips

Capital Properties’ Blog > How to choose the right insurances for your investment property

Enjoy the ride. And remember, we’re here to help if you’re ready to learn! Fast track your learning by coming along to our free personalised Discovery Session – a far easier way to get started than working through this article! J

Get some experts around you to help you on your way.

Free investor tools: Defence Force Property Investor Kit | Our Switched-on Property Investors Program | Discovery Session