At Capital Properties, we understand the unique financial challenges faced by Defence personnel. Our mission is to empower you with the knowledge and tools to achieve financial independence through strategic property investment.

RBA CASH RATE HOLD – April 2025

The Reserve Bank of Australia (RBA) has held the cash rate steady at 4.10% at its latest meeting. With inflation continuing to trend lower, there’s growing optimism that a rate cut may be on the horizon.

Read the official RBA statement here

Inflation Eases Further

The latest data from the Australian Bureau of Statistics shows that inflation is easing. The monthly Consumer Price Index (CPI) reveals that headline inflation slowed to 2.4% over the 12 months to February, down from 2.5% in January – and well within the RBA’s target range.

This has led many economists to predict the possibility of a second rate cut later in the year, potentially as early as May.

Cost-of-Living Relief in the Federal Budget

The Federal Government’s 2025–26 Budget has also offered some welcome relief for households grappling with cost-of-living pressures. Key measures include:

- New tax cuts for Australian taxpayers

- Energy bill relief

- Reduced costs for medicines and student debt

Expanded Support for First-Home Buyers

- In positive news for aspiring homeowners, the Government has announced an expansion of the Help to Buy program.

- Eligible buyers can receive up to 40% equity contribution from the Government

- The scheme aims to help around 40,000 Australians purchase a home with a smaller deposit and mortgage

- Property price and income caps will be raised:

- From $90,000 to $100,000 for individuals

- From $120,000 to $160,000 for couples and single parents

- Around $800 million has been allocated to increase accessibility

Additionally, $54 million has been allocated to support prefabricated and modular housing to boost new home construction.

If you’re considering buying a home or want to learn more about your eligibility for government assistance, we’re here to help. Get in touch to explore your finance options.

Property Market Snapshot

| State/Territory | Auctions / Clearance Rate | Private Sales | Monthly Home Value Change |

| VIC | 1313 / 61% | 1402 | ▲ 0.5% |

| NSW | 1306 / 55% | 1772 | ▲ 0.3% |

| ACT | 72 / 47% | 141 | ▲ 0.2% |

| QLD | 246 / 43% | 998 | ▲ 0.4% |

| WA | 13 / 15% | 569 | ▲ 0.2% |

| NT | 5 / 40% | 24 | ▲ 1.0% |

| TAS | 2 / 50% | 183 | ▼ -0.4% |

| SA | 123 / 67% | 279 | ▲ 0.8% |

Contact us today to learn how we can support your property journey!

OUR TOP TIPS FOR ADF PROPERTY INVESTORS

Could this be a year full of opportunities – are you ready? See where property investment can take you in 2025, is it time to expand your vision?

“We are boxed in by the boundary conditions of out thinking” – Albert Einstein

The last few years have seen a big shift in the Australian property market. Post-COVID disruptions like skilled labour shortages and high material costs have made purchasing or building property challenging for many. But for those who know where to look, 2025 presents plenty of opportunities. At Capital Properties, we work with our clients to help them become ‘Switched on Property Investors’ and make educated investment decisions that align with their financial and lifestyle goals.

In this blog post, we’ll explore some of the top tips for property investors in 2025, highlighting key trends, potential risks, and the best ways to secure your financial future.

Set yourself up for success in 2025. Whether you’re a first-time investor or growing your portfolio, stay ahead of the game by booking your FREE Capital Properties Discovery Session today. Together we’ll make sure you’re ready to take advantages of the opportunities that present themselves.

On the go? Here’s 30 seconds of take outs:

- Interest rates are predicted to stabilise in 2025 – with the first cash rate drop down to 4.1% in Feb 2025.

- Capital Properties advises its clients to act when they’re ready and not to wait for rates to drop.

- Know where to invest. Melbourne & some regional areas may offer better value.

- Rental yields should remain strong, but be mindful of increasing vacancy rates.

- Property investors & first-time buyers could benefit from government incentives; stamp duty concessions, tax benefits & housing grants.

- Potential risks; global economic downturns, interest rate hikes, or oversupply.

- Knowing your financial position is essential.

- Cultivate relationships with property advisors, real estate agents, Buyers Agents & investment experts.

Keep reading >>

Understanding the market: what to expect in 2025

1. Interest rates: stability or surprise?

In Australia, the Reserve Bank of Australia (RBA), led by Governor Michelle Bullock, has kept all of us on our toes waiting for news of changes to interest rates. The RBA determines interest rates based on various factors, including inflation levels (determined by the Consumer Price Index (CPI)) and the overall state of the economy. The cash rate had been set at 4.35% since November 2023, so it continues to dominate news headlines and investor conversations.

At its first meeting of the year, on the 18th February 2025, the RBA announced the first cash rate reduction to 4.1%. However, even with the cash rate change, some banks have dropped / some haven’t dropped their interest rates, so it’ll take a little longer to see how it all plays out.

Overall, most economists seem to agree that 2025 is expected to bring more stability. However, there’s still the potential for fluctuations. And although the Australian market is relatively stable, international influences could create changes that are hard to predict. Keeping an eye on the Reserve Bank’s decisions and market trends will help investors make timely moves. Our blog post “Interest rates – will they drop or stay the same?” is a great place to learn more about how these changes will affect you.

- Top tips for property investors in 2025:

Don’t wait for interest rate cuts – act when YOU’RE ready

If you’re considering property investment in 2025 but waiting for interest rates to drop, think again. The current market still favours buyers, and when rates do decrease, there’s going to be a lot more competition which means property prices are likely to surge. If you don’t have a deposit ready, speaking to a property investment expert could uncover alternative options to make this feasible. The key is to seek out the Capital Properties team for some tailored advice and take action sooner rather than later.

2. Property prices and growth areas

While high-demand areas like Sydney and Melbourne may rebound growth this year, emerging markets in some regional areas and smaller cities could provide excellent opportunities. We’re still seeing that shift towards beach-side and rural living as we identified in our blog post “The big shift towards the ideal Australian Lifestyle”.

For example, December 2024 CoreLogic data showed a strong growth in property prices in regional Queensland, with Adelaide in particular showing significant capital growth. In WA, the beachside areas are enjoying a similar renaissance.

- Top tips for property investors in 2025:

Know the market

As always, the Capital Properties advice to ADF investors is to research, research and then research some more. Pay close attention to locations with infrastructure projects, job growth, and rental demand – often driven by access to local amenities. Think proximity to public transport, schools, parks, shops, cafes and entertainment facilities. Check out our blog post “How to buy well”.

4. Government policies and incentives

ADF property investors and first-time buyers should explore government incentives like stamp duty concessions, tax benefits, and housing grants. These can reduce upfront costs and significantly improve investment outcomes. But finding all that information in one spot can be a pain in the you know what. So, to make your life easier, we’ve created a property investment strategy that’s designed with you, the ADF member in mind.

We strongly urge you to get in touch now and we’ll see what point you’re at and help point you in the right direction to make the most of these incentives.

- Top tips for property investors in 2025:

Know your entitlements

If you can only read one article about the home buyer privileges that you’re entitled to as an ADF member, including government policies and incentives, we suggest you make it this one: “Home buyer entitlements for defence members”. Then book your free Capital Properties Discovery Session to talk to the team about how you can take full advantage of these incentives.

5. Potential risks and how to mitigate them

While the Australian property market holds great potential, investors should be mindful of potential risks such as global economic downturns, interest rate hikes, or as mentioned earlier, oversupply in certain areas. From a big picture point of view, the chaos surrounding the Donald Trump presidency means the global economy remains fragile. And we’re also seeing slowing growth in key trading partners such as China. These factors could trigger an economic downturn, impacting employment and property demand.

There are also specific concerns that can occur at state level such as changes to tenancy laws. For example, some states are considering new legislation such as caps on rent increases or additional rights for tenants which could end up affecting investors bottom line.

- Top tips for property investors in 2025:

Strategic planning for long-term success

Savvy investors can continue to weather these uncertainties by conducting thorough research and clearly defining their property investment strategy – with a plan to create a diversified portfolio. That begins with clarifying your goals and making sure you have clear direction and a detailed action plan to achieve specific targets. Start with this blog post: “Goal setting strategy – The Well-formed outcome”.

6. Make sure you’re ready to act

Knowing your financial position is essential to making the most of investment opportunities when they arise. You need to know exactly ‘what you need to qualify for a home loan’ and start setting aside a financial buffer – around 3 months expenses (each property) as a minimum of is a good benchmark – to cover unexpected costs

and provide peace of mind. Proper preparation will set you up for long-term success in the property market.

- Top tips for property investors in 2025:

Build a strong foundation and gather a supportive team

Having a solid financial foundation and a well thought out plan (aka the Well-Formed Outcome) ensures you’re ready to act when the right property comes along. Yep, it’s those four C’s again – critical thinking, collaboration, creativity and communication.

Read through our ‘ADF Property Buyer Checklist’ and use the Capital Properties Property Investment Tools & Apps to make sure you know exactly where you stand.

It’s also worth bearing in mind that many of the best investment properties never hit the public market. Establishing relationships with property advisors, real estate agents, Buyers Agents and investment experts can give you access to exclusive opportunities. It’s true that behind every success is a support team – great investors know and value the power of collaboration.

At Capital Properties, we help ADF members, ADFA cadets, and first-time investors take confident steps toward financial security. With access to exclusive Property Investment Tools & Apps and our Pinnacle Support Program, you’ll have everything you need to make smart, strategic investment decisions.

Ready to get started? Book your FREE Capital Properties Discovery Session today and start building your financial future.

Note: This information is general advice only. Always do your own research and seek independent financial advice

Request Five Local Government Area’s individual downloadable PDF research reports click on the image below.

WHAT ARE THE BENEFITS OF BUYING AN OFF-THE-PLAN PROPERTY?

Helping ADF members invest in off-the-plan properties with confidence

Setting goals for successful property investment

“In July 2024, realestate.com.au reported that nearly one in three buyers were choosing to build or buy off-the-plan. They suggested this was due to lifestyle changes, financial incentives and a desire for eco-friendly living. And it’s looking very likely that this ‘trend’ is set to continue through 2025 and beyond”.

For Australian Defence Force (ADF) members using property investment to secure a successful financial future, purchasing an off-the-plan property offers substantial advantages. But like all investment decisions, there are pros and cons to buying off-the-plan. In this article we’ll explain what ‘buying off-the-plan’ means and look at the benefits and potential risks you might encounter.

As always, each investment decision should be made according to your own individual situation. That’s why the team at Capital Properties are passionate about helping you make educated decisions that will help you secure your lifestyle and financial goals.

Come along to our FREE Capital Properties Discovery Session to get started. Unsure if you’re ready to invest? Take the Capital Properties Property Investor Quiz and in less than 10 minutes you’ll know where you stand and help you uncover opportunities to take control of your financial future.

On the go? Here’s 30 seconds of take outs:

- Nearly one third of buyers in 2024 were buying off-the-plan

- Buying off-the-plan means committing to buying a property while it’s still in construction.

- Pros of buying off-the-plan:

- Only 5-10% deposit required

- Can lock in the purchase price at current market rates

- Plenty of time to save as off-the-plan builds take around 18-24 months

- Off-the-plan purchases = financial incentives & reduced purchase price

- Enjoy lower maintenance costs & utility expenses all with builders’ warranty insurance

- Modern designs & amenities are appealing to tenants

- Off-the-plan tax & stamp duty benefits

Keep reading >>

What does buying an ‘off the plan’ property’ mean?

Buying off-the-plan essentially means that you’re committing to buying a property before or during construction. The contract to buy is legally binding – just as it would be if you were buying a finished house. For many homebuyers, there are some obvious concerns about buying off-the-plan. Number one being you can’t visit the property and see the finishes until it’s completed. But, for many ADF property investors, there are significant benefits to purchasing an investment property in this way.

What are the benefits of buying off-the-plan?

1. Small deposit

With off-the-plan properties, a maximum deposit of 10% is required at the time of signing the contract. The balance is then payable at settlement once construction is complete. That’s usually at least 12 months, but in some cases, it can be years later.

Plus, many off the plan developments offer promotions allowing you to pay a smaller deposit than you’d pay for an existing property (e.g. 5% deposit instead of a 10% deposit). This is an especially attractive proposition for first home buyers and property investors.

2. Buy now and reap the benefits later

One of the most significant advantages of buying off-the-plan is the ability to lock in the purchase price at today’s market rates. Since property values can increase during construction, you could gain instant equity when it’s finished. This is especially attractive for ADF property investors, because it could mean potential capital growth even before you’ve paid the full balance.

3. More time to save

In Australia, the average timeframe for an off-the-plan build is around 18 to 24 months, obviously depending on the project’s location, size and complexity. This long settlement period allows buyers to save for the final payment and organise a great finance deal. Having this financial flexibility is great for ADF members when postings and deployments affect immediate cash flow.

4. A bigger bang for your buck

Depending on market conditions, with new builds – and especially when buying before construction starts in the early stages on the land development – the purchase price can be lower than an established property. That’s because developers can offer the early stages at a reduced price point early on so they can secure the pre-sales on the project. So, in some situations you can get a brand-new house with all the bells and whistles, for less than you’d pay for an established property that might require maintenance and upgrades.

5. Low maintenance and rental appeal

As we’ve just hinted at, with a new build you can enjoy lower maintenance costs and utility expenses. That’s because newly constructed properties must, by law, adhere to the latest building codes and energy efficiency standards.

For ADF members with demanding schedules or needing to relocate, owning a low-maintenance property will save you a heap of headaches. Also, depending on which state or territory your property’s located in, you should be protected by builders’ warranty insurance. Although every contract will vary, many structural or interior building faults that emerge within an agreed timeframe will also be covered by the builder.

Plus, modern designs and up-to-date amenities also make these properties more appealing to potential tenants. So you’re less likely to have to worry about vacancies.

6. Design input – create the perfect rental

Early commitment to an off-the-plan property will usually allow some leeway for you to personalise the build design. You may get the option to select high-end finishes, choose your preferred colour schemes, or even modify the layout/floorplan. Tailoring the build in this way can help you attract your desired tenants and ultimately enhance your rental income.

7. Tax and stamp duty benefits

Investing in new properties can offer tax depreciation benefits. These benefits allow investors to claim deductions on the property’s depreciation over time. And this makes your accountant’s job to save you a whopping bill at tax time much easier!

Also, several Australian states and territories provide stamp duty concessions or exemptions for off-the-plan purchases, especially for first-time buyers. These can significantly reduce the expenses you get slammed with when you’re buying a property.

For example, in a recent effort to tackle the housing crisis, the Victorian government announced a significant reduction in the stamp duty payable on off-the-plan apartments, units, and townhouses (that are part of a strata subdivision). The potential savings are substantial. That means if a buyer purchases an off-the-plan $620,000 apartment before construction starts, they stand to save a huge 75% or $28,000! This scheme is valid until October 2025.

Cons of buying an off-the-plan property

Purchasing an off-the-plan property offers plenty of advantages for ADF property investors, however there are also risks and challenges that must be considered. When you’re committing to a property before it’s built, unforeseen issues may arise. Let’s take a look at the cons of buying an off-the-plan property:

1. Being sure of the final outcome

When you’re buying an established home, you can get a pretty good picture of the condition by doing a pre-purchase inspection. [We’ve discussed this in our previous blog post “How to buy well”]. And although many builders have display homes that you can view, with an off-the-plan purchase, there’s no physical inspection of the actual property you’re committing to buy. You’re relying on floor plans, artist impressions, and marketing materials to make your decision.

This is often the most challenging part for buyers who want to experience that emotional connection with their new home but should be less of an issue for investors.

2. Plan and specification changes

Most contracts give builders/owners flexibility to make adjustments, such as altering floor plans or fixtures and fittings. Although some changes are due to council requirements, others changes the buyer might make can create additional costs (Admin fees + materials).

3. Potential construction delays

Like any new build, completion dates could (aka probably will) be delayed. After all, they’re still subject to the same approval processes, weather conditions, supply chain disruptions, and labour shortages. These delays can affect your financial planning, especially if you were counting on rental income by a certain date.

4. Market fluctuations

Australian house prices have shown strong growth over the past 30 years and that’s expected to follow a similar trajectory in the future. However, there’s always the risk that the property market can shift, and values can fall between signing the contract and settlement. If this happens the final valuation may be lower than the agreed purchase price. And that could impact your ability to secure financing. It could leave you in the situation where you’re paying the shortfall out of your own pocket.

At Capital Properties, we work with our clients to ensure they understand property cycles and adopt a long-term investment strategy so you can ride out any market changes.

5. Developer stability

At the end of 2024, many people would be forgiven for being anxious about working with a developer. Since the COVID 19 pandemic we’ve struggled with high material costs and skilled labour shortages – see our recent “Housing construction industry update” blog post. This resulted in over 3,200 Aussie construction firms going into administration in 2024.

If your builder/developer faces financial trouble or goes into liquidation before settlement, the project is likely to be delayed or even abandoned. Although you should be able to get your deposit back, the delay means that you could miss out on alternative investment opportunities.

Thankfully, government initiatives to boost housing supply should help. Overall, they’ve promised a $32 billion spend in specific housing initiatives, e.g.: the National Housing Accord, Housing Australia Future Fund and Social Housing Accelerator. This includes $90.6million towards increasing the number of skilled construction workers – keeping building sites running across Australia.

How ADF members can mitigate risks of purchasing off-the-plan

– Due diligence: Take the time to research the developer, builder, and architect’s track record. Make sure they have a history of meeting the deadlines within budget. Read client reviews and ask them about how the communicate project updates and how they handle issues when they arise.

– Get expert help with the legal stuff: Off-the-plan contracts can be complex, with potential hidden costs like land tax adjustments, project delays, building specification alterations and even changes in government regulations. Make sure you work with someone who’s familiar with off-the-plan purchases. Capital Properties Buyers Agent service is a great place to start.

– Know the market: Locking in a price can be a great deal, but property values might change while it’s being built. To avoid potential pitfalls, it’s essential to keep an eye on the market. That means knowing what’s happening globally, nationally and in the specific investment area. For example, if there’s any potential new developments in the area, you’ll need to consider if the market could become oversaturated and/or the local infrastructure can keep up.

Start by requesting a copy of the latest Capital Properties FREE Australian property market report.

– Have a financial buffer: It’s super-important to plan for possible changes in lending requirements, settlement valuations, or changes in your personal circumstances during the construction period. The Capital Properties Investment Tools & Apps make budgeting a whole lot easier.

Next steps with Capital Properties

Buying off-the-plan can be a strategic move, but careful planning and thorough research are vital. At Capital Properties, we specialise in helping ADF members navigate the property market to ensure their investments align with long-term financial and lifestyle goals. As ex-Defence, we understand the unique challenges of military life and it’s our mission to provide tailored advice and support throughout the purchasing process.

If you’re considering buying off-the-plan, have a chat with our expert team about what opportunities are available to you. Book your Capital Properties Discovery Session today, and let our expert team guide you through the process.

Remember, as a Capital Properties client, you have exclusive access to our Property Investment Tools & Apps and the Pinnacle Support Program, designed to support you at every step of your investment journey.

Note: This information is general advice only. Always conduct your own research and seek independent financial advice before making investment decisions.

At Capital Properties, we understand the unique financial challenges faced by Defence personnel. Our mission is to empower you with the knowledge and tools to achieve financial independence through strategic property investment.

Recently, the Reserve Bank of Australia (RBA) reduced the cash rate target to 4.10%. This decision reflects positive progress in controlling inflation, which has decreased to 3.2% as of December. Contributing factors include subdued private demand and easing wage pressures.

However, the RBA remains cautious due to ongoing tightness in the labour market and slight upward revisions in inflation forecasts for 2026. Economic growth has been slower than anticipated, with uncertainties surrounding household spending recovery. Global geopolitical and financial risks further contribute to this unpredictability.

At Capital Properties, we stay abreast of these developments to provide you with informed investment strategies. Our goal is to help you navigate the current economic landscape, ensuring your property investments are both resilient and profitable.

Let us guide you towards a secure financial future.

At Capital Properties, we recognise the importance of reliable property insights. Whether you’re buying, selling, or refinancing, we’re here to guide you every step of the way. Our team works closely with trusted professionals to ensure you have accurate, dependable valuations to help you make informed decisions.

Contact us today to learn how we can support your property journey!

Source: www.rba.gov.au/media-releases

HEARD ABOUT THE CO-LIVING INVESTMENT PROPERTY?

Co-Living Investments: Cash Flow Opportunities and Challenges for Property Investors

The real estate landscape is constantly evolving, with new trends emerging to meet changing demographics and lifestyle preferences. One of the most talked-about investment opportunities in recent years is co-living properties. As housing affordability declines and urban areas become more densely populated, co-living has grown in popularity. That’s because co-living provides flexible and community-oriented living solutions.

In a July 2024 Core Logic report, Head of Research – Eliza Owen stated that “there are stronger rental growth trends in larger dwellings, potentially reflecting the formation of share houses or multiple family households, with an 8.7% rise in rent for houses with five bedrooms or more.”

But is investing in co-living properties the right move for ADF investors? In this blog post, the property investment experts at Capital Properties break down the pros and cons of co-living property investing, so you can make informed investment decisions.

Interested in property investment but unsure where to start? The Capital Properties our FREE Capital Properties Discovery Session is designed to help ADF investors navigate opportunities like co-living with confidence.

Talk to our team to get the insights and expert guidance you need to build a strong, future-proof portfolio.

On the go? Here’s 30 seconds of take outs:

- Co-living is like shared housing, where individuals rent private bedrooms within a larger, communal property.

- It offers a viable solution to the Australian rental crisis.

- The strategy to invest in co-living properties must align with your investment goals & strategy.

- Pros of investing in co-living:

- Higher rental income

- Strong demand in urban areas

- Reduced vacancies

- Professional property management

- Better re-sale potential

- Cons of co-living property investment:

- Higher operating costs

- Regulatory challenges

- Increased tenant turnover

- Property design/renovation considerations

- Market risks

- Before investing in a co-living property:

- Conduct market research to identify high-demand areas.

- Partner with experienced property managers

- Comply with local housing & zoning regulations

- Take ongoing costs into consideration

Keep reading >>

What is co-living?

Co-living is a modern take on shared housing, where individuals rent private bedrooms within a larger, communal property. These properties typically feature shared common areas such as kitchens, laundries, living rooms, workspaces and/or gardens, that can foster a sense of community among residents. It’s especially popular with young professionals, digital nomads, and students who value affordability, convenience, and social connection.

Plus, as we’ve discussed in our blog post “Housing affordability/rental crisis/extremely low vacancies. What does it all mean?”, the lack of affordable housing, extremely low vacancies, and increased demand has led to a rental crisis in Australia. To tackle the issue, the Federal Government created a $10 billion Housing Australia Future Fund for tens of thousands of new homes. However, with increased migration, changing family structures and more overseas students coming back to Australia, the demand for rentals is not slowing down. This makes an excellent argument for increased access to co-living housing.

Pros and cons of co-living investment properties

As with all investments, there are pros and cons that need to be carefully considered. Making the decision to invest in co-living properties should align with your investment goals and overall investment strategy. If you haven’t yet clearly identified your short, mid- and long-term goals, recommend you meet with the Capital Properties team to make sure you’re headed in the right direction. You can check out our Capital Properties Goal Setting Strategy – The Well-Formed Outcome here to get started.

The pros of investing in co-living properties

1. Higher rental yields

- Higher rental income – multiple tenants mean multiple rent payments, maximising your returns. For example, a 3-bedroom property rented out to one family could bring in $500 per week. However, if you convert it into shared housing and lease each room for $250, you could earn $750 a week.

This diversified income stream reduces financial risk if one tenant moves out.

2. Strong demand in urban areas

- With skyrocketing property prices in major cities, many people, especially young professionals and students, are priced out of the traditional rental market. Co-living offers them an attractive, affordable option.

Although we don’t have exact data, an SBS News article on co-living in April 2024 reported that a study done by the University of Queensland and Griffith University found that the number of people living communally rose by over 40% between 2001 and 2016. It’s (modestly) estimated that more than 25,000 Australians live in co-living spaces. And we think that’s growing even more quickly post-pandemic.

3. Reduced vacancy rates

- The flexibility of shorter lease terms appeals to a wide tenant base which means co-living properties have lower vacancy rates compared to standard rentals.

It also means that vacancies are filled more quickly. This is especially beneficial in cities with transient populations, such as Sydney and Melbourne.

4. Professional management services

- Most co-living spaces have specialist property managers who handle tenant sourcing, rent collection, maintenance and community engagement.

This “hands-off” investment model allows property owners to enjoy a passive income with minimal day-to-day involvement.

5. Better re-sale potential

- Co-living properties often outperform dual occupancy properties in resale value due to their higher rental yield and broader market appeal.

- The growing demand for affordable, community-driven housing is attractive to both investors and future owner-occupiers.

Multiple income streams increase their perceived value, offering greater liquidity and flexibility in the property market.

Cons of co-living investment properties

1. Higher operating costs

- Co-living properties often come with increased operational expenses because landlords typically cover utilities, internet, and cleaning services.

More tenants = increased communal area maintenance which adds to ongoing expenses.

2. Regulatory challenges

- Different cities and states have varying zoning laws and regulations for co-living. For example, local councils can impose occupancy limits.

Compliance with fire safety and other regulations is essential.

3. Increased tenant turnover

- Co-living tenants often prefer flexible, short-term leases.

Frequent turnover means more time and resources spent on tenant acquisition (advertising/contracts etc).

4. Property design considerations

- Not all properties are suitable for co-living. Renovations may be required to add extra bathrooms or improve shared spaces.

Layouts must be designed to balance privacy with community living.

5. Market risks

- Like any real estate investment, co-living is subject to market fluctuations and shifts in housing trends.

Reduced demand or regulatory changes could impact future rental income and property value.

Is co-living the right investment choice for you?

Investing in co-living properties presents a unique opportunity to maximise rental yields while tapping into a growing market. However, the rewards come with additional management responsibilities and potential regulatory risks.

If you’re considering a co-living investment strategy, make sure to:

- Conduct thorough market research to identify high-demand areas. Get in touch with the Capital Properties Team to get your copy of the Australian Property Market Report.

- Partner with experienced property managers who specialise in co-living. Capital Properties can recommend trusted professionals – just give us a buzz.

- Ensure full compliance with local housing laws and zoning regulations.

Factor in ongoing costs like utilities and maintenance when assessing returns. The Capital Properties Property Investment Tools and Apps are a Godsend when it comes to managing complex accounts. For example, use the Capital Properties Rental Property Income Tax Return checklist to help you prepare your tax return in a timely manner.

Ready to explore co-living investment properties?

o-living property investment offers an exciting real estate trend that looks likely to continue for the foreseeable future. At Capital Properties, we understand the opportunities and challenges of co-living investments. Yes, the potential for higher yields and low vacancy rates makes it an attractive investment option, but ADF property investors must also consider higher operational costs and regulatory considerations.

If you’re new to property investing and are wondering if co-living is a good place to start, book your FREE Capital Properties Discovery Session so our expert team can guide you through every step.

Already in the market and keen on exploring co-living as an alternate investment to diversify your portfolio? Then the Capital Properties Pinnacle Support Program will support you to capitalise on this growing sector of the real estate market.

Note: This information is general advice only. Always conduct your own research and seek independent financial advice before making investment decisions.

WHAT IS BETTER? A BANK VALUATION OR SALES APPRAISAL?

How much is your property worth?

Why a bank valuation is more reliable than a sales appraisal

We’re often asked, “what’s the best way to determine the value of a property”? There are two common approaches that come to mind: a bank valuation and a sales appraisal. Both provide insights into a property’s worth. However, a bank valuation and a sales appraisal serve different purposes and can yield varying results. In this blog post we’ll discuss why we believe a bank valuation is the more accurate, reliable and practical option to determine your property’s value.

Want to know your property’s true value? We’ll help you understand when and how to get the best appraisal – and show you how to use it to your advantage.

Book your FREE Capital Properties Discovery Session and take the first step toward financial freedom.

On the go? Here’s 30 seconds of take outs:

- A bank valuation is a formal assessment that determines a property’s value using data, e.g.: comparable sales, market conditions & risks

- Bank valuations are used for legal reasons e.g. wills, divorce settlements, property disputes & tax assessments.

- A sales appraisal is performed by a real estate agent to estimate a potential selling price.

- Sales appraisals consider the property’s features (number of rooms etc), appeal & liveability.

- A sales appraisal will tell you what your property ‘could’sell for, but a bank valuation will offer a more accurate valuation.

- In the current market, refinancing is the main driver of valuations.

Keep reading >>

Understanding bank valuations

A bank valuation is a formal assessment conducted by an independent, licensed valuer. The goal of a bank valuation is to assess the property’s true market value based on tangible data like recent comparable sales, current market conditions, and potential risks.

It’s usually requested by a financial institution like a bank, credit union or building society. The primary objective is to provide these lenders with an accurate and legally recognised understanding of the property’s worth in order to minimise financial exposure.

The bank valuation is presented as a formal, written assessment and it includes a precise estimate of a property’s value. Because the valuation is impartial – it’s usually very accurate. Hence, bank valuations are often used for legal requirements such as for wills and deceased estates, divorce settlements, property disputes, and tax assessments.

Our previous blog post “Desktop, Kerbside & Full Property Valuations – What’s what?” explains the different types of valuations in greater detail.

The role of sales appraisals

A sales appraisal is usually performed by a real estate agent. Their aim is to estimate the property’s potential selling price in the current market.

When a real estate agent appraises a property, they consider the property’s features, appeal, and liveability. They’ll typically compare it to other recent sales in the area and suggest a comparative cost based on location, the number and size of bedrooms and bathrooms, property condition, land size, outdoor spaces, special features like a pool, and potential for future development or renovations.

These appraisals often present a more optimistic figure to attract sellers, but they may not always align with actual sale prices. That’s because they are susceptible to agent bias, market fluctuations, or seller expectations.

A bank valuation or sales appraisal? Why bank valuations are superior

- Objectivity: Bank valuations are independent and free from sales targets or emotional influences, providing an unbiased assessment. That means the figure provided reflects the property’s true value, unaffected by market hype or negotiation tactics.

- Risk management: Bank valuations determine lending amounts. This ensures that borrowers do not overextend financially, and lenders avoid financing overvalued properties.

- Consistent methodology: Bank valuations adhere to strict guidelines and data-driven methodologies, including analysis of comparable sales, property conditions, and location-specific factors to ensure consistency and reliability.

Credibility in financial decisions: Bank valuations hold significant weight in financial and legal contexts, such as refinancing or legal disputes. Sales appraisals, on the other hand, are rarely accepted in these contexts due to their subjective nature.

Why the type of valuation matters

While a sales appraisal might provide a snapshot of what your property ‘could’ sell for, it can’t guarantee accuracy. A bank valuation, however, gives you a realistic perspective, making it the better option for critical decisions like securing a mortgage or refinancing.

Current market valuation insights

According to CoreLogic, the Australian property market is expected to remain stable, with refinancing still being the main reason for valuations. Many pandemic-era fixed-term loans have now expired, so borrowers are likely to consider refinancing – especially as interest rate reductions are predicted to create favourable lending conditions in the latter half of 2025.

As long as the Reserve Bank continues to lower interest rates, the housing market should see renewed purchasing demand. Many high-growth areas like Perth, WA are predicted to show particularly strong activity.

How Capital Properties supports your investment journey

As we push further into 2025, securing accurate valuations is essential for successful property investment. At Capital Properties, we recognise the importance of reliable property insights. Whether you’re buying, selling, or refinancing, we’re here to guide you every step of the way. Our team works closely with trusted professionals to ensure you have accurate property valuations to help you make informed decisions.

Contact us today to learn how we can support your property journey!

Or book straight into your FREE Capital Properties Discovery Session and let our expert team guide you through the process.

Note: This information is general advice only. Always conduct your own research and seek independent financial advice before making investment decisions.

Economy – Future Prospects

Navigating economic trends for ADF property investors

Understanding the economic outlook

For Australian Defence Force (ADF) property investors, understanding the economic outlook is essential to making smart investment decisions. As we write at the end of 2024, the Australian economy is at a crossroads. With a steady inflation – now under 3% – and unemployment rate of 4.1% here in Australia the future prospects for the Australian economy are promising.

However, factor in global uncertainties and the outlook looks slightly less auspicious. In this post, we’ll examine the relevant global and Australian economy and what the future prospects mean for your property investment strategy.

At Capital Properties, we understand the unique challenges and opportunities faced by ADF members. As we approach the end of the year, it’s the perfect time to review your financial goals. Is your portfolio performing as you’d expected? Are you positioned for success in 2025 and beyond? And are you up to date with what’s happening with the economy and how that affects your future prospects?

If you’re not answering “100% yes” to these questions, then book in for your FREE Capital Properties Discovery Session and gain access to our Property Investment Tools & Apps and Pinnacle Support Program.

On the go? Here’s 30 seconds of take outs:

- Inflation is currently steady at under 3% & unemployment is low at 4.1%.

- Global economic growth is slowing, with risks from geopolitical tensions & policy changes in major economies like the US & China.

- Consumer confidence is improving as interest rate hikes pause, but borrowing costs are still high.

- Consumer Price Index (CPI = measure of inflation) is easing but rising Producer Price Index (PPI) signals ongoing cost pressures.

- Many Australian property markets retain a steady growth, particularly in regional and outer suburban areas. ADF investors can take advantage of: strong property prices, interest rate reductions & rental demand.

- Key trends to watch are sustainability in property, infrastructure development & population growth/migration.

Keep reading >>

Global influences on the Australian economy

The global economy has faced significant challenges over recent years. From the Covid 19 pandemic disruptions to geopolitical tensions – i.e. Russia vs Ukraine, war in the Middle East, and the return of Donald Trump to the Oval Office (which could potentially alter our relationship with China) – it’s all feeling rather tumultuous.

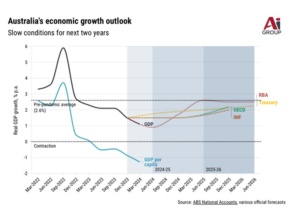

The latest World Economic Outlook from the International Monetary Fund (IMF) shows that global economic growth is steady but slower than hoped, with risks leaning toward things getting worse. There’s a predicted slowdown in major economies like the US and China. So we’re likely to see the effects of inflationary pressures, central bank interventions, and fluctuating trade dynamics. However, because Australia is blessed with valuable natural resources, we benefit from the global demand for energy, minerals, and agricultural goods. This should be enough to ensure our economy remains resilient.

In the RBA Board September Monetary Policy meeting, when discussing the relationship between Australia’s monetary policy settings and global central banks they said “Members agreed that, while it was important to take account of economic developments abroad, it was not necessary for the cash rate target to evolve in line with policy rates in other economies, since Australian inflation was higher, the labour market stronger and monetary policy less restrictive than in many other advanced economies. The exchange rate could also adjust as interest rate differentials between Australia and other economies evolved.”

Australian economy – future prospects

According to the Australian Industry Group (AIG), economic growth is expected to be modest over the next two years. Gross domestic product (GDP) growth is likely to stay around 1.6%, potentially improving slightly to 1.8% in 2025. The AIG attribute a decline in business investment, housing investment and export growth to this stall of economic growth. They also emphasise that “one of the principal factors dragging on the Australian economy is inflation. Despite some recent improvements, it is proving stubbornly difficult to bring under control.”

We’ll take a closer look at where we’re at with inflation in the next section…

It does seem however that lower interest rates have finally started to boost consumer spending. In November 2024, the Westpac–Melbourne Institute Survey of Consumer Sentiment Index (which measures changes in the level of consumer confidence in economic activity) showed that consumer confidence reached its highest level in 2.5 years. This was mostly because households were reassured that interest rates wouldn’t rise further. Although, to be fair, overall confidence is still relatively low and many households are still struggling.

According to recent Australian Prudential Regulation Authority (APRA) data, around 35,000 Australian households are unable to repay their mortgages. That represents approximately $23 billion in loans – a figure that’s doubled since 2016 – so it paints a grim picture.

What’s happening with inflation in Australia?

Consumer inflation – measured by the consumer price index (CPI) peaked at 7.8% per year in late 2022. Thanks to a slowing economy and 13 (almost consecutive) interest rate hikes, we’re now closer to the target 2-3%, sitting at 2.8%. It is, of course the Reserve Bank of Australia (RBA)’s job to monitor inflation and we know they’re aiming for a steady target of 2-3%. And, if you’re sitting there wondering what inflation has got to do with property investment – have a quick read of our blog post “What is the relationship between inflation and interest rates?”.

But as well as monitoring CPI, we also need to take the Producer Price Index (PPI) into account. The PPI tracks business costs and unlike the CPI, it’s unfortunately rising again – now sitting at 4.8% per year. And we can’t blame global issues like supply chain problems and energy costs like we did in 2022. Inflation is now mainly caused by local issues. Prices for goods traded internationally are rising slowly at 1.5% per year, but non-tradable items like services, which are affected by wage increases, have much higher inflation at 5% per year.

The future prospects for inflation still look challenging. The Treasury predicts that inflation will stay above target for another year, and the RBA expects it could take two years. This means interest rates probably won’t drop as soon as many would like. And that means that borrowing will stay relatively expensive and living costs are likely to remain higher than we enjoyed pre-pandemic.

What the economy – future prospects mean for ADF property investors

As an ADF member, you’re in a unique and pretty privileged position. Your steady income and Defence Force housing entitlements offer remarkable financial security. And with the Capital Properties team in your corner, you can navigate changeable economic conditions with greater confidence. Despite all the uncertainties in the current and future economic landscape, we’ll help you look at the factors that might impact your property investment opportunities:

- Property prices

Despite the economic turbulence in the last few years, the Australian property market is showing great resilience. Housing trends indicate steady growth in high-demand areas, particularly in regional and outer suburban locations. ADF personnel can take this advantage of this by staying up to date on housing trends. Our blog post “Australian housing trends” is a great place to start.

- Interest rates

With inflation easing and interest rates stabilising, it’s predicted that we’ll see interest rate reductions in early to mid-2025. Lower rates could mean more affordable borrowing, allowing you to expand your property portfolio. And utilising government and Defence Force grants can get you there even sooner. Check out our blog post “Buying a house while in the defence force” for more details.

- Rental demand

The rental market remains tight, with vacancy rates still maintaining historic lows. This trend is likely to continue for some time, providing strong rental yields for property investors. For ADF members, this can translate into additional income streams while posted elsewhere.

Trends to watch if you’re thinking of investing in property in 2025 (& beyond)

To stay ahead in the property game, it’s essential to keep abreast of what’s happening in the market. Here are several key trends we’ll be monitoring:

- Sustainable property

In Australia, the Federal Government works with state and territory governments to develop cohesive regulations through the National Construction Code (NCC). That includes regulations around sustainability and energy efficiency. There are fundamental procedures that must be adhered to – such as the Deemed-to-Satisfy (DTS) elemental provisions for energy efficiency (Section 13 of the Housing Provisions). The good news is that getting on board with eco-friendly features in your investment property is very likely to increase property value and attract long-term tenants.

- Infrastructure development

Keep an eye on areas that are, or will be, benefiting from infrastructure upgrades. Projects like new transport links or schools can significantly boost local property values. For example, the upcoming Western Sydney Airport has sparked interest in nearby areas like Badgerys Creek. New roads, business hubs, and residential developments are underway. Getting in early and investing in areas with projects like transport links or schools have the potential of strong capital growth.

Plus, thinking outside the box, for example investing in commercial spaces, can also pay dividends. Read our November 2024 blog post “Industrial warehouse office conversion” to hear about our experience with re-developing a commercial space.

- Population growth and migration

Australia’s population is growing steadily. Driven largely by migration, which accounted for 81% of the country’s growth in 2023 according to the Australian Bureau of Statistics (ABS). Regional areas are also experiencing an influx, as migrants and locals alike explore opportunities outside major cities. This increases housing demand, opening up potential opportunities for property investors.

Capital Properties: supporting ADF property investors

We know that a career in the ADF doesn’t always allow you the indulgence of time to keep up with what’s happening with the Global or Australian economy. And the knock-on effect on the property investment market. That’s why the expert team at Capital Properties are here to guide you. With years of experience working alongside ADF members, we understand your needs and goals. We’ll help you navigate the economic landscape so that you can build a secure future and achieve financial freedom.

Book your FREE Capital Properties Discovery Session and/ or follow up with the Switched-On Strategy Series now.

Note: This information is general advice only. Always do your own research and seek independent financial advice

What’s happening in the Australian construction industry?

Lets Review the Challenges facing Australian housing construction

We think it’s fair to say that nobody will be surprised to hear of the tumultuous couple of years we’ve experienced in the housing construction industry here in Australia. It seems like every few weeks we’re hearing of another construction company going under. And the stats show the sector is sadly still suffering the highest rate of insolvencies of any industry. The corporate watchdog Australian Securities & Investments Commission (ASIC), reported 2832 construction industry insolvency appointments in the 2024 financial year. A depressing 28% more than the previous year.

It’s why the Albanese Labor Government has focused on housing in the 2024–25 Budget with its promise to invest $90.6 million in the construction and housing sector. In this housing construction industry update, we’ll explore recent trends, challenges, and opportunities for investors, particularly those in the Australian Defence Force (ADF).

As property investment specialists, the team at Capital Properties know how vital it is to support the construction industry and educate investors on how to navigate this tricky market. It’s our job to make sure you know how take advantage of property investment opportunities to secure long-term financial future.

Book your Capital Properties Discovery Session to meet with our expert team and make sure you’re primed for investment opportunities. And remember, Capital Properties clients have access to our Property Investment Tools & Apps and Pinnacle Support Program.

On the go? Here’s 30 seconds of take outs:

- 2024 saw an increase in construction industry insolvency

- The government promised $90.6 million for the construction & housing sector in the 2024–25 Budget.

- Out of$258 billion worth of work in 2023, only $81 billion was in housing construction.

- Experts say that that 205,000 new homes per year are required but less than 175,000 new homes were built in 2023.

- Opportunities in the market:

- Housing shortages means increased demand

- Population growth

- Net zero targets

- Issues facing the market:

- Supply chain disruption

- Higher material costs

- Skilled labour shortages

- Inflation and the cost of living

- Lower housing approvals & net zero

Keep reading >>

Current housing construction situation

It might sound counterintuitive to hear that Australia’s overall construction industry is actually experiencing growth. The engineering sector, which focuses on building infrastructure for transport, energy, industrial, etc., has grown by 8.3% this year, and accounts for around half of all construction activity in Australia. However, home building isn’t following the same trend. Out of $258 billion worth of work in 2023, only $81 billion was in housing construction.

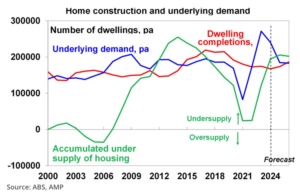

This stalemate in housing construction, combined with other factors like increased population growth, has led to a significant shortage of rental accommodation which many are calling “the housing crisis”. Economists at the Housing Industry Association (HIA) have said that 205,000 new homes will be required each year to meet demand. With fewer than 175,000 new homes built in 2023, we’re falling well short of what’s required.

On the 8th of May 2024, Julie Collins, the Minister for Housing, Homelessness and Small Business said: “Our Government knows that building more homes is the best way to address Australia’s housing challenges, which is why we have an ambitious national target to build 1.2 million homes.”

Issues and opportunities in Australian housing construction

So, let’s take a closer look at the current housing construction situation. Firstly, there are great opportunities for growth due to:

- Housing shortages = increased demand

- Population growth

- Net zero targets

But the industry is facing significant issues, including:

- Supply chain disruption

- Higher material costs

- Skilled labour shortages

- Inflation and the cost of living

- Lower housing approvals

- Net zero (yes, it’s an opportunity and an issue)!

We’ll examine each of these further below.

FACTORS DRIVING HOUSING CONSTRUCTION DEMAND

At the time of writing (October 2024) it’s projected that 167,000 new homes will have been built this year. And the expectation is that it’ll average out to approximately 180,000 per year thereafter. This falls well short of the recommended 205,000 homes required to meet demand. Of course, this varies across different states and territories, but some states like Queensland are feeling it the most.

Source: https://www.amp.com.au/insights-hub/blog/investing/econosights-state-housing

Population growth

The Australian Bureau of Statistics (ABS) confirmed that Australia’s population reached a record 27 million earlier this year – and it shows no sign of slowing down. Almost 650,00 people arrived in Australia in the 12 months to March 2024. Australia’s population grew by 164,635 in the first 3 months of the year alone – 133,802 of those from overseas migration. This has led to a severe housing shortage, particularly in urban rental accommodations, driving rental prices higher and putting immense pressure on the housing market.

The ABS have predicted that overseas migration could continue to increase Australia’s population from 27 million in 2024 to somewhere between 34.3 and 45.9 million people by 2071.

Net zero targets

The Australian Government has developed an ‘Infrastructure Net Zero’ Initiative, working with government and industry stakeholders to create policies and encourage innovation to achieve the decarbonising of infrastructure. With support from organisations like the Australian Contractors Association and researchers from the University of New South Wales (UNSW), a national reference guide has been created to help move Australia towards its net zero target.

This innovation will of course come at a cost (estimated at $1.3m) to achieve new emissions targets, and specialist knowledge will be required. So, yes, this offers an opportunity for innovation and growth. But, in an already struggling industry these new challenges will be another obstacle to surmount.

AUSTRALIAN HOUSING CONSTRUCTION CHALLENGES

Supply chain disruption and higher material costs

The pandemic highlighted major issues with Australia’s construction supply chains. Customers were more understanding of the delays and shortages of critical materials in 2020, but the recovery isn’t happening as quickly as anyone would like. With global economies still reeling, the supply chain disruptions look set to continue for some time yet.

Materials like timber, steel, and concrete are still harder to come by, and higher shipping and production costs are continuing to drive up prices. The Hays Construction Industry Report Australia FY24/25 reported a 5.9% increase in overall construction prices in last year. These rising costs affect project timelines and budgets, making it difficult for developers to maintain a profit.

Skilled labour shortages

The Australian construction industry is facing a severe shortage of skilled workers. The above-mentioned Hays Construction Industry Report states that Australia will need 90k new construction workers – immediately – in order to meet the government’s housing targets. Build Australia puts the figure closer to 130,000.

In the Feb 2024 ABS ‘Job Vacancies Survey’ construction businesses reported almost 280,000 job vacancies across the sector. That’s why the government announced a spend of $90.6 million in the 2024-2025 budget to increase the number of skilled construction workers. This includes a program for incentivised (or free) TAFE training and encouraging migration of skilled workers.

Interestingly the Irish Government had launched an expensive advertising campaign aimed at encouraging skilled labour to “build back home” to fill a shortfall of 50,000 jobs in Ireland. So, it will be interesting to see if our government’s plan to encourage migration of skilled workers will work.

Either way, these solutions certainly seem like long-term fixes to an immediate problem.

Inflation and the cost of living

Many Australian households are barely coping after 13 (almost) consecutive interest rate hikes in 15 months since May 2022. Rents are at an all-time high and essential items such as food, utilities and mortgage repayments have almost doubled in some cases. That means that people are more likely to stay in their existing homes, rather than risk applying for mortgages at higher rates. And many would-be homeowners have been priced out of the market.

Elevated borrowing costs also means that some developers have been cautiously awaiting more favourable interest rates before investing or re-investing.

Lower housing approvals

The combination of higher material costs, labour shortages and high interest rates result in less developers applying for new housing (dwellings). In fact, new dwelling approvals in Australia are at the lowest they’ve been for 12 years. For the year to June 2024 almost 163,000 houses and apartments were approved. That’s a drop of 8.5% on the previous year and the lowest we’ve seen since 2011-12.

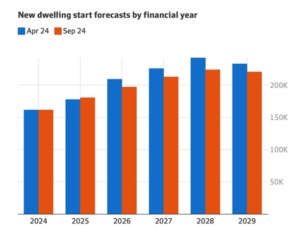

Michael Bleby, Deputy Property Editor from Australian Financial Review (AFR) wrote in September 2024 that Labor’s hopes of building 1.2 million new homes in five years are fading fast. Master Builders Australia (MBA) estimates that only 1,033,962 new homes will be built over the five years to 2029, which is down more than 53,000 from the 1,087,325 total it predicted in April.

Outlook for Australian housing construction

In the Housing Industry Association (HIA) “Housing Australia’s Future 2024 Report”, they say: “this analysis has defined a range in which building activity will need to sit over the next thirty years. This is to account both for population growth and for the various factors defined throughout this report that influence housing demand. At an Australia-wide level, it is estimated to be between 190,000 and 275,000 new homes per year.”

The government is under pressure to relieve the current ‘housing crisis’ and the budget reflects this. With the Housing Australia Future Fund and the National Housing Accord they’ve allocated more than $9.5 billion to housing in this financial year. The good news is that economists predict this will start paying off. It’s predicted that there will be solid growth from 2026, with total building increasing to $130.4 billion – an increase of 9%.

Opportunities in the Australian housing market

To meet the escalating demand, the housing construction industry will need to invest in building innovation and sustainable practices as well as skilled labour. Builders are forced to offer more attractive workplace benefits, including competitive salaries along with training and development programmes that allow for career progression. This investment will pay off in the long term with more economical and efficient practices and better retention for skilled workers.

This housing construction industry update shows that changes are necessary to facilitate increased construction and they can’t come quick enough. Both state and territory governments are under pressure to streamline building approvals, and grants are available to encourage the adoption of innovative construction methods such eco-friendly buildings or prefabrication as well as investment in technology.

High rents and rental yields mean that many investors are taking advantage by putting money into new builds. The Australian Bureau of Statistics (ABS) show investor loans for new home construction increased by 7% before seasonal adjustment from June 2024 to $1.6 billion.

For ADF property investors, the changes in the housing construction industry presents challenges, but also opportunities. The team at Capital Properties are keeping a close eye on market trends and government initiatives aimed at boosting housing supply. It’s our mission to help you understand these dynamics so you can make informed decisions on when and where to invest to meet your long-term financial goals.

To make sure you’re perfectly poised to take advantage of any investment opportunities, we recommend that you book into our FREE Capital Properties Discovery Session and/or our Switched-On Strategy Series.

Note: This information is general advice only. Always do your own research and seek independent financial advice

Matthew’s journey from property investment client to consultant

At Capital Properties, we pride ourselves on not only helping Australian Defence Force (ADF) members achieve their property investment goals but also on nurturing and supporting our clients beyond their service years.

Matthew Bondarczuk’ s journey is a testament to this commitment. Starting out as a client of Capital Properties, Matthew has transitioned to a pivotal role as a Property Consultant within our expert team. Looks like he saw something in us, just as we did in him! This is his story.

Our free Capital Properties Discovery Session is designed to help you make informed investment choices and take advantage of the various entitlements for Defence members.

You can click on the link to book, visit our website, or call 1300 653 352 to speak to Matthew or another Capital Properties expert.

On the go? Here’s 30 seconds of take outs:

- Matthew Bondarczuk served 10 years in the Royal Australian Navy.

- He acquired qualifications in Leadership, Business, Engineering, & Risk Management & is completing a Bachelor of Business, majoring in property & development.

- Matthew received the Navy Innovation Award for the research study: “Financial Education – A Critical Retention Tool for the Royal Australian Navy”.

- Matthew became a client of Capital Properties between 2016 & 2017, then transitioned to a role as Property Consultant in 2024.

- His passion for property investment & dedication to helping others achieve financial stability make him a valuable asset to the Capital Properties team.

Keep reading >>

Meet Matthew Bondarczuk

Matthew grew up in sunny Perth, Western Australia, At the age of 17, he pursued his dream of joining the Australian Defence Force, fulfilling that ambition with distinction by serving for 10 years in the Royal Australian Navy as both a sailor and an officer.

Not one to rest on his laurels, Matthew pursued extensive education in the Navy, completing multiple engineering qualifications and associated diplomas in leadership and project management. He was awarded the Navy Innovation Award for his paper submission and research study titled “Financial Education – A Critical Retention Tool for the Royal Australian Navy.”

The Former Chief of Navy Michael Noonan testified that “Matt is a dedicated, highly respected, and widely experienced Naval Officer. With qualifications in Leadership, Business, Engineering, and Risk Management, he is a very versatile leader and Defence professional. Matt is driven and conscientious and goes out of his way to help others.”

What drives Matthew

Matthew is an avid traveller and 4WD enthusiast. But giving back is where he finds true satisfaction. He dedicates his spare time to volunteering, assisting veterans, and representing the Australian Veteran Alliance in the DVA Young Veterans Contemporary Needs Forums.

Not one to shy away from challenges, Matthew will admit that one of his most onerous experiences was completing the clearance diver assessment in the winter of 2018. This rigorous process tested his physical and mental limits, but it also solidified his resilience and determination. And it’s that same grit that impressed us here at Capital Properties when we first had the pleasure of meeting him.

Transitioning to Capital Properties

Matthew became a client of Capital Properties between 2016 and 2017 when he sought out the guidance of our strategic property investment services. Matthew’s first impression of Marcus Westnedge (Owner of Capital Properties) was that he was easy-going, switched-on property expert, whose expertise and approachable nature made a lasting impression.

And Marcus could see that Matthew had a very similar vision to his own when it came to building a brighter future for himself and his family, as well as a drive to help others in the ADF achieve their future financial success.

From Client to Consultant

Matthew believes that serving our nation is crucial and often undervalued. He saw the potential of leveraging Australian property as a growth asset to provide financial stability post-service. His own successful property transactions ignited a passion for property investment, leading him to dedicate himself to helping others achieve similar success. To ensure his proficiency, he’s currently three-quarters of the way through a Bachelor of Business, majoring in property and development.

So, when Matthew joined the Capital Properties team as a Property Consultant in 2024, we knew his firsthand experience as a client meant he had a clear understanding of Capital Properties operations, values, and dedication to our clients’ success. And his experience and education give him unique insights into the challenges and opportunities faced by ADF members choosing to invest in property. All of which meant his transition into the Property Consultant role at Capital Properties was seamless.

Matthew’s property investment success

Capital Properties helped Matthew achieve his goals through strategic investment planning and emphasising the importance of time in the market rather than trying to time the market.

Together with his wife Brehanna, they’ve built a substantial portfolio while maintaining a healthy lifestyle balance. This personal success story is a testament to the effectiveness of Capital Properties’ property investment strategies. And it’s meant that Matthew has been able to enjoy a successful balance between professional growth and personal fulfillment.

Matthew highlights three key elements that make Capital Properties stand out:

- The widely experienced and personable Capital Properties team

- The new Capital Properties office in Coolum

- Making a positive impact on the ADF/veteran community

Matthew’s property advice for ADF Members

Matthew believes that property investment in Australia can be incredibly empowering as a growth asset, and he emphasises the importance of diversifying your strategy to include a balance of cash flow and capital growth.

But, before you do anything, book in for a FREE Discovery Session. Matthew agrees that it really is the best place to start your property investment journey. Then, he advises establishing a savings goal and setting up a locked (two-to-sign) savings account with someone you trust. This discipline can significantly accelerate your savings and investment journey.

When it comes to making that all-important property investment purchase, Matthew advises removing emotion from the buying process and engaging a professional. Emotional decisions can lead to overpaying, while data-driven decisions ensure informed investments.

And get to know your entitlements. ADF members benefit from a low-cost living lifestyle, housing subsidies, corporate partnerships with lenders for preferential rates, and significant concessions in certain states/territories, which can save up to $50,000 in some cases. These advantages make property investment an especially beneficial strategy for ADF members. Check out Defence Force loans and entitlements here.

On a personal level, Matthew, his wife Brehanna, and their daughter Morgan plan to travel around Australia over the next few years. The plan is to settle down in the NSW alpine region while continuing their property investment journey to build generational wealth. And we wouldn’t be surprised if one of his investments included a winery as he’s been itching to learn winemaking.

Right now though, Matthew aims to assist others in unlocking their financial futures through strategic property investment, helping them achieve long-term financial freedom.

Matthew’s passion for property investment and dedication to helping others achieve financial stability make him a valuable asset to our team. We are proud to have Matthew on board and look forward to the continued success of our clients, guided by his expertise and experience.

Matthew Bondarczuk’s journey from client to consultant at Capital Properties exemplifies the transformative power of strategic property investment. You can enjoy the same success and the best place to start is with our FREE Discovery Session.

Managing your investments is made easier and more efficient with our Capital Properties free online tools and apps.

Industrial Warehouse Office Conversion: Capital Properties HQ on the Sunshine Coast

Sunshine Coast HQ enhances work and lifestyle

From warehouse to workplace – the commercial conversion that feels like home

At Capital Properties, we’re all about creating spaces that support our goals, both in life and in business. Our recent(ish) move to a converted industrial warehouse in Coolum Beach is a testament to this philosophy. After having settled in for more than a few months now, we’re thrilled to say our Sunshine Coast headquarters (HQ) has proven to be a huge success. The conversion process was reasonably straightforward – we talked about the details in this blog post: “Capital Properties sunshine coast headquarters project” and it’s been worth every cent.

It really is more than just a workspace – it’s elevated almost every aspect of our daily lives. We’re proud to have created a space that supports our team’s productivity, lifestyle, and connection with community. It turns out we’re not the only ones enjoying this new way of working/living. Read on to learn why warehouse conversions are a trend that’s worth embracing.

Book a Capital Properties Discovery Session to see how warehouse conversions can elevate business and lifestyle and become savvy investments.

And remember, as a Capital Properties client, you’ll gain access to our exclusive Property Investment Tools & Apps and comprehensive Pinnacle Support Program to support your investment journey.

On the go? Here’s 30 seconds of take outs:

- Capital Properties HQ is now located in a converted industrial warehouse at 18 Lomandra Place, Coolum Beach.

- The space supports productivity, lifestyle, and connection with community.

- The location is close to several breweries, a bakery and even a water park!

- There’s plenty of parking and the space feels light and airy.

- The team uses the Pomodoro Technique to maintain energy and focus.

- We love sharing the space with Wilson Designer Homes.

- Warehouse conversions are the perfect solution for modern businesses and are growing in popularity.

Keep reading >>

Prime location for work and lifestyle

First things first, one of the main reasons for the success of our new space is of course, the location. Yep, that old chestnut: location, location, location! The new Capital Properties HQ is conveniently located at 18 Lomandra Place, Coolum Beach, just minutes from Capital Properties Founder, Marcus Westnedge’s home. And it’s close to local schools, so it’s perfect for drop-offs and pick-ups, making our workday commute/family commitments pretty seamless. There aren’t many offices that you can literally drive right into in less than 6 mins after leaving home!

And because we’re all about balance here at Capital Properties, we didn’t want an office destination that was just about work. It’s why we intentionally chose a vibrant spot that would add some extra enjoyment to our day-to-day.

Three doors down is Black Flag Brewery, a local favourite for after-work relaxation, and nearby Coolum Beach Brewing Co. serves delicious meals along with a great brew.