There’s no denying the impact that COVID-19 has had on stock markets and property markets. But what does this mean for property investors?

Is there opportunity to be found in our current situation? In this article we take a look at how COVID-19 compares to previous market downturns and consider exactly what impact it may have on longer term property market recovery.

On the go? Here’s 30 seconds of take outs:

- The current climate is truly unique and it’s hard to predict when it may pass, but we know that at some point it will pass.

- There are good reasons to believe that the property market and economy could rebound quite positively out of this current crisis.

- Opportunity is all about perspective – could this be the right time to take stock and consider your investing goals?

Keep reading >>

Well, we’ve had an extraordinary start to the year. No matter your generation or age I think it’s safe to say that we’ve never experienced anything like this before. Unless, that is, you’re among the centenarians alive today who lived through the Spanish flu from 1918 – 1920.

The current situation has sent panic through the stock market. And when we look at property market, it seems to have done a complete 180 from the strong start experienced earlier in the year as sales numbers decline.

So, what does it all mean for property investors?

It’s hard to know what to make of it all right now. The current climate raises uncertainty for many investors. It might seem difficult to make the right decision. Maybe you’re thinking ‘I’m going to wait and see what happens’ or ‘I might relook at investing later in the year’.

A decision not to invest in times like this can be easily justified.

But the Australian residential property has historically fared well against negative economic shocks. This isn’t the first time that we’ve been through tough times even though in the middle of the storm it’s hard to see the light of day and get your bearings.

What’s important to remember is that this phase will pass and we will eventually get through to the other side.

“Vendors may view the current pandemic as a temporary economic condition. If monetary and fiscal stimulus can adequately support business and household income amid the slowdown, then the next few months could see a sharp contraction in sales volumes, but not necessarily dwelling values.

This is because the expectation would be for market activities to return. Influenza periods for example, typically last 3-4 months. It is unclear whether coronavirus will be seasonal, but, after mass quarantines, China is now showing a slowed spread of the coronavirus. South Korea is also seeing a drop off in new reported cases after a social distancing campaign” – Source: www.corecogic.com.au.

Let’s compare COVID-19 to other market down turns.

1991 recession

The 1991 recession was driven by:

- High rates of inflation

- Common effects of inflation: erodes purchasing power, encourages spending, investing, causes more inflation, raises the cost of borrowing, lowers the cost of borrowing, reduces unemployment, increases growth, reduces employment and growth and weakens or strengthens currency.

- High rate of account deficit

- A trade deficit means there is more being bought than there is being sold by a country. If a current account deficit remains on the books for a long time, it can mean future generations will be burdened with high debt levels and large interest payments.

The effects of the 1991 recession included:

- A large number of businesses went bankrupt and some of the major banks almost went under.

- Unemployment rose from 5.8% to 11.2%

How did this effect the property market?

- It is important to remember as with the economy the property markets have different drivers so it was a mixed bag.

- Melbourne property prices fell by more than 10%, while other markets grew like Queensland which saw property price increases in Brisbane and the Gold Coast over that period of time.

The 2008 Global Financial Crisis (GFC)

The GFC really came about because of relaxed lending standards by the banks, which ultimately resulted in sending a lot of banks in the US and Europe into bankruptcy which caused a cascade effect and a global economic meltdown.

The 2008 GFC was the greatest economic downturn in the US history since the 1930’s Great Depression. People couldn’t access the finance they needed.

‘But you can’t borrow your way to a good time forever, and this recent example of a credit-fuelled boom was no exception’ – Luci Ellis.

The 2008 Global Financial Crisis drivers:

- Human psychology: When times are good, perceptions of risk diminish.

- Lending standards eased

- High loan-to-value ratio loans

- Lo doc loans common

- High household debt

The 2008 Global Financial Crisis effects:

- All capital cities in Australia saw property prices fall but the government took measures including First home buyer stimulus’ which kick-started a market recovery.

- As stimulus took effect, we saw housing prices start to rise thereafter, so it was a very short sharp downturn in the housing market and the recovery was quite rapid.

COVID-19

In terms of the housing market it is very difficult to say whether the current climate will look more like the 1991 recession or the 2008 GFC, or something else altogether. Because when we look at it, COVID-19 is a health issue at its core.

The overall concern with the economy is that it will continue to shrink due to people being unable to work or losing their jobs over the coming months.

The SARS outbreak in Australia had a pretty minimal impact from a housing perspective but worldwide there were only 9,000 cases of SARS.

COVID-19 is being experienced on a large scale. It’s effecting more countries around the world and we don’t have a timeline on when it’s going to pass.

So, in a nutshell, we’re in a pretty unique position and it’s hard to predict how this one will play out.

Thoughts on COVID-19 and the real estate market

Firstly, there’s been no shut down of the real estate or building industry! Businesses continue to operate while observing all the new safety measures and guidelines the government has put in place.

But confidence has taken a big hit. Housing is a high-commitment, high-confidence purchasing decision. It’s reasonable to expect that over the coming months we’ll see fewer sales.

However, we don’t predict it will be as dramatic as the 2008 GFC or even as we saw in Melbourne during the 1991 recession.

This is because there’s a huge amount of stimulus in the market now:

- Interest rates are the lowest they’ve ever been

- FHOG is available

- Reduced AUD is good for exporters

- Government stimulus packages are available to help people struggling including:

- Job Keeper subsidy

- Rental assistance package

- Bank loan deferral programs are also available

Once confidence does start to return and people start to spend the rebound out of this current crisis could be quite positive.

What if this is an opportunity?

What if buying now could be a strategic gain in the months to come through investing in the right markets and or negotiating discounts in others.

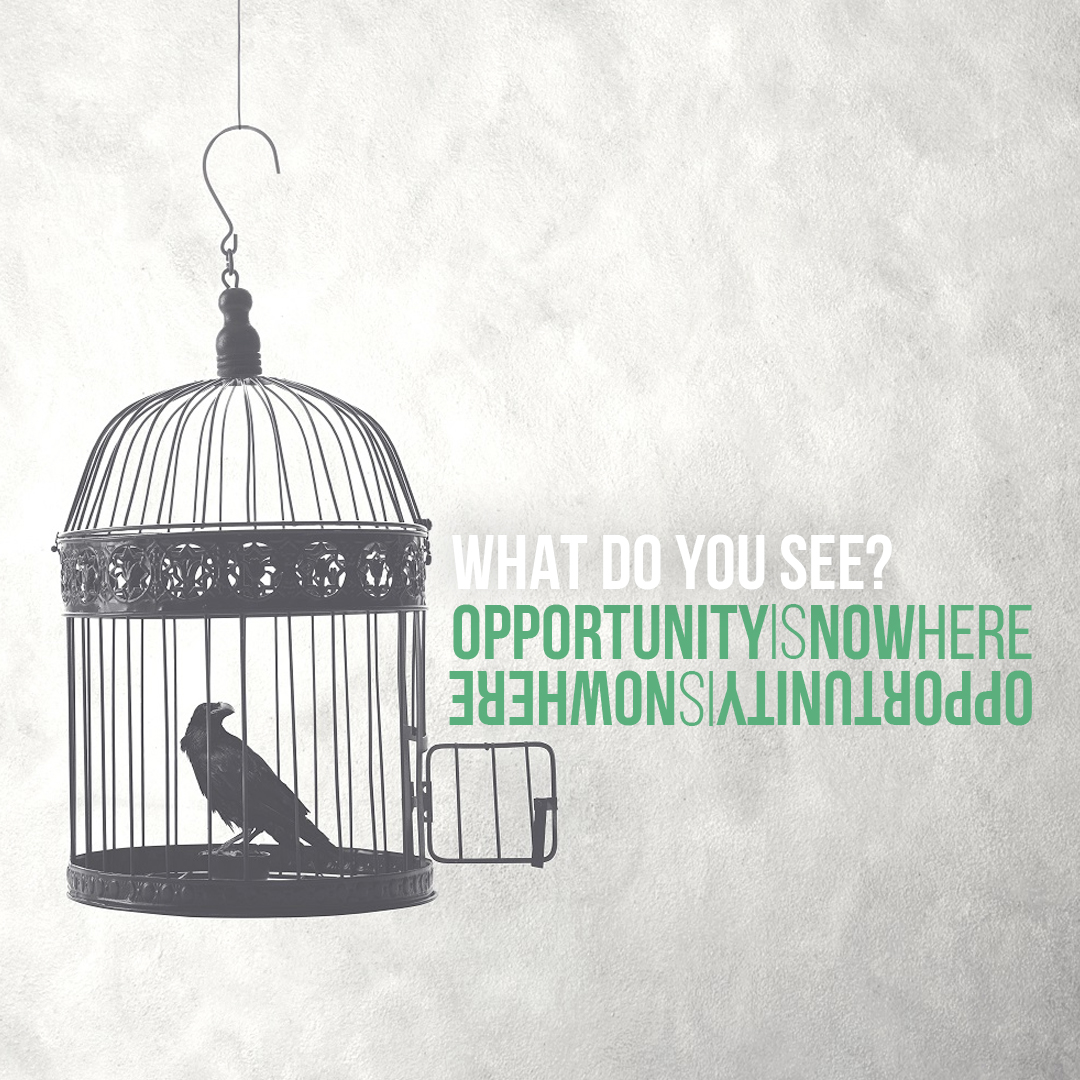

Take a look at the phrase below.

OPPORTUNITYISNOWHERE

What do you see?

Some people will see ‘opportunity is nowhere’, others will see ‘opportunity is now here’.

The difference is perspective.

And the same lesson can be applied to our current situation as we deal with a global pandemic.

My job is to help you shift your perspective and understand that opportunity is now here to those who are positive, proactive and responsible.

Source: For some of this content: Cameron Kusher Executive Manager Economic Research | www.realestate.com.au

Property investing too hard to start by yourself?

Learn and grow with a Capital Properties discovery session.

Book into our free discovery session today and we’ll get to know each other, explore goals and discover property investment possibilities for you based on your current Defence pay rate and lifestyle.